spark-servis.ru

Learn

Debt Service Coverage Loan

The Debt Service Coverage Ratio (sometimes called DSC or DSCR) is a credit metric used to understand how easily a company's operating cash flow can cover its. DSCR LOANS · (Debt Service Coverage Ratio) · RESIDENTIAL INVESTMENT LENDING BASED ON THE CASHFLOW POTENTIAL OF THE HOME. What Is The Debt Service Coverage Ratio (DSCR)?. The DSCR, or debt service coverage ratio, measures how much of your income particular debts consume. A DSCR ratio above indicates that there is sufficient cash flow to cover debt payments. Lenders often require DSCR ratios above or , depending on. How to Calculate DSCR. Debt service coverage ratio by definition is the net operating income a property can generate, divided by the amount of Annual Debt. This loan type is geared towards real estate investors and focused more on the debt service coverage ratio (DSCR) of the investment than the borrower's personal. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. The debt service coverage ratio (DSCR) is used to measure a company's cash flow available to pay current debt. Learn how to calculate the DSCR in Excel. To lenders, a higher DSCR signals a lower risk, because it means a borrower can more easily handle their debts. And it isn't just for businesses. In terms of. The Debt Service Coverage Ratio (sometimes called DSC or DSCR) is a credit metric used to understand how easily a company's operating cash flow can cover its. DSCR LOANS · (Debt Service Coverage Ratio) · RESIDENTIAL INVESTMENT LENDING BASED ON THE CASHFLOW POTENTIAL OF THE HOME. What Is The Debt Service Coverage Ratio (DSCR)?. The DSCR, or debt service coverage ratio, measures how much of your income particular debts consume. A DSCR ratio above indicates that there is sufficient cash flow to cover debt payments. Lenders often require DSCR ratios above or , depending on. How to Calculate DSCR. Debt service coverage ratio by definition is the net operating income a property can generate, divided by the amount of Annual Debt. This loan type is geared towards real estate investors and focused more on the debt service coverage ratio (DSCR) of the investment than the borrower's personal. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. The debt service coverage ratio (DSCR) is used to measure a company's cash flow available to pay current debt. Learn how to calculate the DSCR in Excel. To lenders, a higher DSCR signals a lower risk, because it means a borrower can more easily handle their debts. And it isn't just for businesses. In terms of.

The debt service coverage is determined by dividing the total annual income available to pay debt service by the annual debt service requirement. CB&S Bank A Debt Service Coverage Ratio or DSCR compares two things: The operating income real estate investors have available to service their debt versus their. If you don't qualify for a loan based on Debt Service Coverage Ratio (DSCR), it means that your income is not sufficient to cover the debt service on the loan. While several factors are considered in commercial loan underwriting, debt service coverage is primary among them and indicates a borrower's capacity to. Debt service coverage ratio (DSCR) loans are designed for rental property investors who wish to leverage the income generated by their investment rather than. To calculate the debt service coverage ratio, simply divide the net operating income (NOI) by the annual debt. Commercial Loan Size: $10,, Interest Rate. DSCR provides a basis for determining the maximum loan amount an investment property can withstand. The higher the DSCR, the bigger the mortgage the property. DSCR Loans for LLCs. Use the income generated from your property for your LLC to qualify for a debt service coverage ratio (DSCR) loan. Key Features. All. Debt service: This is the amount of cash needed to pay the required principal and interest of a loan during a given period. Once you've determined your net. Debt service coverage ratio is a metric commonly used to underwrite income property loans. It measures how much cash flow is available for debt service (i.e. DSCR loans work by calculating the Debt Service Coverage ratio, which identifies whether a property can cover its own debts. The rental income is divided by. Real estate investors seeking an investment property loan should consider their debt service coverage ratio (DSCR) to measure their cash flow and ability to. The Debt Service Coverage Ratio is a measure of a property's Net Operating Income (cash flow) to its annual loan payments / debt obligations and it is used by. There are many different tools used for assessing loan eligibility. One of these tools – the debt service coverage ratio (DSCR) – can help lenders get to. DSCR Loans, or debt service coverage ratio loans, are used for financing short-term or long-term rental properties and allow borrowers to qualify based on. In commercial lending, debt-service coverage is the ratio between your business's cash flow and debt. Try Peoples State Bank's online calculator today. This financial ratio is a primary tool used by lenders to assess the risk associated with an investment loan. It provides a snapshot of a potential borrower's. DSCR loans provide long-term financing for a rental (buy-and-hold) investment strategy. The Debt-Service Coverage ratio (DSCR) measures your ability to repay. A DSCR above 1 indicates that the property generates more income than needed to cover its debt, providing a cushion for the investor and lender. For instance, a. DSCR loans are a type of loan that is specifically designed for businesses that have a strong Debt Service Coverage Ratio. What Is the Debt-Service Coverage.

What Is The Late Fee For Filing Taxes Late

Penalty is 5% of the total unpaid tax due for the first two months. After two months, 5% of the unpaid tax amount is assessed each month. Summary · 1. Late Filing Fee/Penalty, Late fee of $50 or 5% of tax, whichever is greater. Maximum of $ Late fee of $ or 5% of tax, whichever is greater. The late filing penalty is 5% of the additional taxes owed amount for every month (or fraction thereof) your return is late, up to a maximum of 25%. If you. Late Filing Penalty: If you file after the due date, include a Late Filing Penalty of $ Late Payment Penalty: A late payment penalty equal to the fee or. Penalties · 5 percent late pay, or failure-to-pay, penalty on tax not paid by the original due date, even if there's a valid extension. · 20 percent late filing. Keeper's calculator lets you know how much your late filing penalty will cost — and if you read on, you'll also find tips for paying your late taxes and. Like the late filing penalty, the late payment penalty is assessed at a rate of 6% per month, with a maximum penalty of 30%. The late payment penalty will not. Late-filing fee: $50 · Delinquent interest: % per month (18% per year). · Negligence penalty for failure to timely file: 5% per month of the tax required to be. If your return is over 60 days late, there's also a minimum penalty for late filing; it's the lesser of $ (for tax returns required to be filed in ) or. Penalty is 5% of the total unpaid tax due for the first two months. After two months, 5% of the unpaid tax amount is assessed each month. Summary · 1. Late Filing Fee/Penalty, Late fee of $50 or 5% of tax, whichever is greater. Maximum of $ Late fee of $ or 5% of tax, whichever is greater. The late filing penalty is 5% of the additional taxes owed amount for every month (or fraction thereof) your return is late, up to a maximum of 25%. If you. Late Filing Penalty: If you file after the due date, include a Late Filing Penalty of $ Late Payment Penalty: A late payment penalty equal to the fee or. Penalties · 5 percent late pay, or failure-to-pay, penalty on tax not paid by the original due date, even if there's a valid extension. · 20 percent late filing. Keeper's calculator lets you know how much your late filing penalty will cost — and if you read on, you'll also find tips for paying your late taxes and. Like the late filing penalty, the late payment penalty is assessed at a rate of 6% per month, with a maximum penalty of 30%. The late payment penalty will not. Late-filing fee: $50 · Delinquent interest: % per month (18% per year). · Negligence penalty for failure to timely file: 5% per month of the tax required to be. If your return is over 60 days late, there's also a minimum penalty for late filing; it's the lesser of $ (for tax returns required to be filed in ) or.

IRS Definition · The combined penalty is 5% (% late filing and % late payment) for each month or part of a month that your return was late, up to 25%. · The. If you didn't file your return by Tax Day and didn't request an extension to file, the IRS can impose a 5% failure-to-file penalty on any unpaid taxes for each. Late Filing Penalty. 5% per month, or part thereof, up to 5 months, is added to the net tax owed if your return is late. If the return is more than 60 days late. Penalty for Filing Taxes Late. If you fail to file a tax return by the due date, there is a penalty equal to five percent of the tax due. The penalty. The failure-to-file penalty is usually five percent of the tax owed for each month, or part of a month that your return is late, up to a maximum of 25%. Depending on the circumstances, the Department may grant extensions for filing an excise tax return. The request must be made before the due date. Penalty. Note: Withholding income tax payment due dates are based on the assigned payment schedule. Late-payment penalty for underpayment of estimated or quarter-monthly. IRS Definition · The combined penalty is 5% (% late filing and % late payment) for each month or part of a month that your return was late, up to 25%. · The. A $50 late filing fee/penalty may be assessed on returns filed after the due date. See Late Filing Penalties (PDF). A 5 percent penalty is assessed on tax due. Returns filed more than 60 days after the original due date are assessed a $50 late filing penalty, even if no tax is owed, unless an extension has been filed. Penalties ; Late Filing · 5% of the tax not paid by the original due date, and an additional 5% for each additional month the return is late. 25% of the tax due*. If you owe tax and do not file before the April deadline, the total failure to file penalty is usually 5% of the tax owed for each month, or part of a month. Form & Form late filing penalty generally is % (or %) of the taxes remaining unpaid as of the unextended due date for each month or part of a. At the very least, file or e-file a tax extension to reduce the late filing penalty as it is significantly higher than the late payment penalty. The penalty for. The law requires DOR to assess a 9% late penalty if the tax due on a return filed by a taxpayer is not paid by the due date. Late penalties of 19 to 29% proceed. If you fail to pay your taxes, the IRS will penalize you based on how long your overdue taxes remain unpaid. The penalty will be a percentage of the taxes you. You will owe a 5 percent late-payment penalty on any Oregon tax not paid by the original due date of the return, even if you have filed an extension. The amount of penalty for late reporting is an additional 10 percent of tax due. An additional penalty for late payment is charged 60 days after due date or. If you're more than 60 days late, the minimum penalty is the smaller of % of the taxes you owe or $ You could also get hit with a failure-to-pay penalty. The IRS combines the late filing and late penalty payments each month you are subject to both. The maximum penalty per month is % for filing late, plus.

How Much Is Dog Medical Insurance

How Much Is Pet Insurance? On average, dog insurance costs $47 per month and cat insurance costs $29 per month. Your actual costs may be higher or lower. Pets Best: Cheapest pet insurance. · Lemonade: Excellent for fast claims processing. · Fetch: Great for covering boarding fees. · Healthy Paws: Great for cheap cat. PHI Direct covers 80% of eligible veterinary treatment costs due to new accidents or illnesses up to an annual policy limit of $5, or $10, It covers. Providing pets with the highest quality medicine starts with a strong foundation of preventive care. That's why we offer two ways to save on veterinary care for. The average accident and illness plan pet insurance premium in was $ per month for dogs, and $ for cats. Pet Pros can guide you through your pet's health situation and help you decide if and how soon you should see a vet. How much is pet insurance? Several. Choose the best pet insurance plan for your dog or cat, so you don't have to compromise on your pet's care in case of an illness or an accident. Enjoy unlimited payouts on covered cost. Your coverage won't be dropped no matter how many claims you file. Rated #1 by vets. Trupanion medical insurance. *Prices vary depending on the species, breed and where in Canada you live. Policy premiums are calculated based on Canadian veterinary fees. Wellness coverage. How Much Is Pet Insurance? On average, dog insurance costs $47 per month and cat insurance costs $29 per month. Your actual costs may be higher or lower. Pets Best: Cheapest pet insurance. · Lemonade: Excellent for fast claims processing. · Fetch: Great for covering boarding fees. · Healthy Paws: Great for cheap cat. PHI Direct covers 80% of eligible veterinary treatment costs due to new accidents or illnesses up to an annual policy limit of $5, or $10, It covers. Providing pets with the highest quality medicine starts with a strong foundation of preventive care. That's why we offer two ways to save on veterinary care for. The average accident and illness plan pet insurance premium in was $ per month for dogs, and $ for cats. Pet Pros can guide you through your pet's health situation and help you decide if and how soon you should see a vet. How much is pet insurance? Several. Choose the best pet insurance plan for your dog or cat, so you don't have to compromise on your pet's care in case of an illness or an accident. Enjoy unlimited payouts on covered cost. Your coverage won't be dropped no matter how many claims you file. Rated #1 by vets. Trupanion medical insurance. *Prices vary depending on the species, breed and where in Canada you live. Policy premiums are calculated based on Canadian veterinary fees. Wellness coverage.

Pet insurance assists in covering the costs of your vet bills. You pay a premium each month to the insurance company, and in return, you can care for your. Pet medical insurance can help reduce financial stress when choosing care for your dog or cat. For a monthly premium based on your pet's age, breed, location. Several insurers write pet insurance coverage which is intended to cover many of the costs associated with obtaining any medical advice, diagnosis, care, or. A pet health insurance policy reimburses the pet owner for covered veterinary care. As with your health insurance policy, these policies typically itemize. Accident & Illness coverage of $7, or $15, annually means you can concentrate on helping your pet get the best treatment available without worrying about. The average cost to insure a dog ranges from $ to $ per month among insurers in our rating of the best pet insurance companies. Whether you have a puppy or adult dog, routine vet visits come with the territory. But when your pal needs unexpected veterinary care, the costs often add. On average, you might expect to pay anywhere from $20 to $50 per month for basic coverage, while comprehensive plans can cost upwards of $ The average monthly cost of pet insurance in the US is $35 for dogs and $20 for cats. Learn how Fetch can make vet bills more affordable. When deciding whether to purchase coverage, there are several considerations that that should go into your decision besides the cost of the coverage. It's surprisingly affordable and, best of all, customizable to fit your budget. So, how much does pet insurance actually cost? According to US News, you're. In New York, an accident and illness plan costs an average of $33 per month for dogs or $41 a month for cats. New York discounts. Nationwide protects more than 1,, pets · Pet insurance premiums starting at $13/mo.* · Visit any licensed veterinarian in the United States · Cancel at any. BestBenefit plan for dogs A BestBenefit plan can cover everything an Accident Only plan does, plus any illness your dog suffers, unless it involves a pre-. It covers the eligible costs of treating accidents and illnesses. Helpful resources for pet parents. View articles. Dog. At Lemonade, a policy for a dog or a cat starts at $10/month. (Plus our affordable pet health insurance has won the approval of authorities like spark-servis.ru). Pet insurance costs depend on different variables, such as your pet's species, breed, age, health condition, and medical history, in addition to where you live. Pet health insurance from Figo can help you cover the cost of your Pet Medical Insurance. We understand what it's like to be a pet parent: Pets. Pet health insurance provides coverage for unforeseen medical expenses such as non-pre-existing illnesses and injuries. This can help make health care for your. Our plans for dogs start as low as $13/month. Get a quote today. Why do I need insurance for my dog?

Price Dividend Growth Fund

The T. Rowe Price Dividend Growth ETF (TDVG) seeks dividend income and long-term capital growth primarily through the common stocks of dividend-paying. The Fund seeks to provide increasing dividend income over time, long-term growth of capital, and a reasonable level of current income through investments. This fund is designed to provide investors with some income while offering exposure to dividend-focused companies across all industries. PDGIX | A complete T Rowe Price Dividend Growth Fund;I mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Find the latest performance data chart, historical data and news for T. Rowe Price Dividend Growth Fund, Inc. (PRDGX) at spark-servis.ru An equity fund that focuses on high-quality, mid- to large-cap companies with the potential for sustainable dividend growth. The fund normally invests at least 65% of its total assets in stocks, with an emphasis on stocks that have a strong track record of paying dividends or that. Fund highlights · Core equity investment: By investing in high-quality companies committed to sustainable and growing dividends, the portfolio may be a. The fund has returned percent over the past year and percent over the past three years. Historically, the fund has developed a solid track record. As. The T. Rowe Price Dividend Growth ETF (TDVG) seeks dividend income and long-term capital growth primarily through the common stocks of dividend-paying. The Fund seeks to provide increasing dividend income over time, long-term growth of capital, and a reasonable level of current income through investments. This fund is designed to provide investors with some income while offering exposure to dividend-focused companies across all industries. PDGIX | A complete T Rowe Price Dividend Growth Fund;I mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. Find the latest performance data chart, historical data and news for T. Rowe Price Dividend Growth Fund, Inc. (PRDGX) at spark-servis.ru An equity fund that focuses on high-quality, mid- to large-cap companies with the potential for sustainable dividend growth. The fund normally invests at least 65% of its total assets in stocks, with an emphasis on stocks that have a strong track record of paying dividends or that. Fund highlights · Core equity investment: By investing in high-quality companies committed to sustainable and growing dividends, the portfolio may be a. The fund has returned percent over the past year and percent over the past three years. Historically, the fund has developed a solid track record. As.

Dividends can also help reduce the fund's volatility during periods of market turbulence and help offset losses when stock prices are falling. T. Rowe Price Dividend Growth Fund · Price (USD) · Today's Change / % · 1 Year change+%. PRDGX - T. Rowe Price Dividend Growth Fund, Inc. has disclosed total holdings in their latest SEC filings. Most recent portfolio value is calculated to. Latest T. Rowe Price Dividend Growth Fund (PRDGX) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile. Analyze the Fund T. Rowe Price Dividend Growth Fund having Symbol PRDGX for type mutual-funds and perform research on other mutual funds. Analyze the Fund Fidelity ® Dividend Growth Fund having Symbol FDGFX for type mutual-funds and perform research on other mutual funds. Learn more about. Large-cap portfolio of primarily Canadian equities with high dividend growth rates and high current yields · Dividend growth reflects company's ability to grow. Dividend Growth Fund seeks to provide, primarily, a growing stream of income over time and, secondarily, long-term capital appreciation. The Dividend Growth Fund can offer investors a sectoral diversification from Canadian equity securities. Learn more on our website. 1. DGRO offers low-cost exposure to U.S. stocks focused on dividend growth · 2. Access companies that have a history of sustained dividend growth and that are. The investment seeks dividend income and long-term capital growth primarily through investments in stocks. The fund normally invests at least 65% of its total. The Dividend Growth Fund invests primarily in stocks of large U.S. companies that have a history of increasing their dividends. Learn more. The fund normally invests at least 65% of its total assets in stocks, with an emphasis on stocks that have a strong track record of paying dividends or that are. Get T. Rowe Price Dividend Growth Fund (PRDGX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. See performance data and interactive charts for T. Rowe Price Dividend Growth Fund (PRDGX). Research information including trailing returns and hypothetical. The investment seeks dividend income and long-term capital growth primarily through investments in stocks. The fund normally invests at least 65% of its. This fund invests primarily in preferred shares and dividend paying common shares of Canadian companies. It is currently expected that investments in. The portfolio manager uses artificial intelligence to help identify stocks with remarkable dividend growth potential. Historical Pricing. Closing Price As At. Key Fund Data ; Yield. % ; Net Expense Ratio. % ; Turnover %. 16% ; Portfolio Style. Growth & Income ; Inception Date. December 30, TD Dividend Growth Fund - I ; MER. % MER as of December 31, ; Total Fund Assets (Millions)**. $ ; Minimum Investment. $ ; Minimum Subsequent.

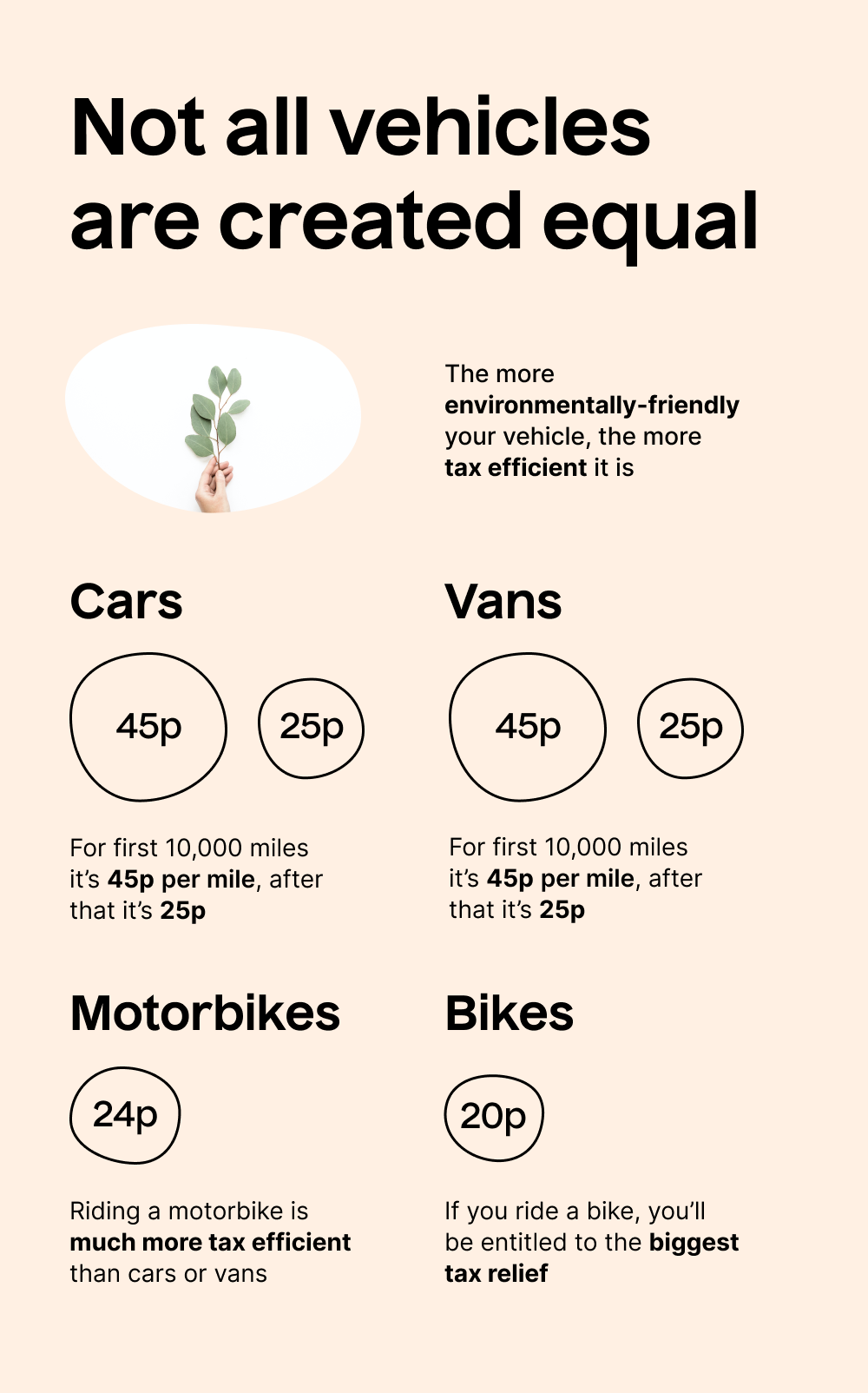

How Much Per Mile For Taxes

22 cents per mile for medical and moving purposes; 14 cents per mile for charitable organizations. Federal Mileage Rates ( Tax Year). The IRS mileage rates. The California Mileage Tax proposal would require tracking every driver's mileage and charging them four cents per mile they drive. That is the equivalent of an. The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The standard mileage rate is a universal rate that covers all the costs associated with tax-deductible mileage. If you make payments to employees above a certain amount, you'll have to report them to HM Revenue and Customs (HMRC) and deduct and pay tax. “The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile,” the Internal Revenue Service. You can deduct business miles or expenses if you are self-employed or an independent contractor and use your vehicle for work. Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, , The standard mileage rate is the cost per mile that the Internal Revenue Service (IRS) allows for taxpayers who claim the use of a vehicle as a deductible. 22 cents per mile for medical and moving purposes; 14 cents per mile for charitable organizations. Federal Mileage Rates ( Tax Year). The IRS mileage rates. The California Mileage Tax proposal would require tracking every driver's mileage and charging them four cents per mile they drive. That is the equivalent of an. The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The standard mileage rate is a universal rate that covers all the costs associated with tax-deductible mileage. If you make payments to employees above a certain amount, you'll have to report them to HM Revenue and Customs (HMRC) and deduct and pay tax. “The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile,” the Internal Revenue Service. You can deduct business miles or expenses if you are self-employed or an independent contractor and use your vehicle for work. Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, , The standard mileage rate is the cost per mile that the Internal Revenue Service (IRS) allows for taxpayers who claim the use of a vehicle as a deductible.

The General Services Administration adopts the IRS standard automobile mileage rate in accordance with 5 USC (a)(1). TDY Rate. The TDY mileage rates. 14 cents per mile driven in service of charitable organizations, the rate is set by statute and remains unchanged from Per IRS webpage, the IRS increased. Privately-Owned Vehicle (POV) Mileage Rate = $/ mile. Source: IRS Announcement Privately-Owned Aircraft Mileage Rate = $/ statute mile. Reimbursement rates since ; , cents/mile, $/mile ; , cents/mile, $/mile. Learn about your IRS mileage rate, and see how depreciation factors into the equation. The IRS standard mileage reimbursement rate (67 cents per mile) is used when a state owned vehicle is not available. A lesser rate (60 cents per mile) is. What is the current IRS mileage rate? For travel January 1, - December 31, , the IRS has increased the mileage rate to $/mi as noted here on their. Claiming a tax deduction for mileage can be a good way to reduce how much you owe Uncle Sam, but not everyone is eligible to write off their driving costs. Standard mileage rate ; , , ; , , ; , , ; , , Standard mileage. Multiply your business miles driven by the standard rate. For , the rate is $ per mile. This rate includes driving costs, gas. The mileage rates show a cent increase in the business mileage rate ( cents in ) and a 1 cent decrease in the rate for medical and moving. You can deduct the difference between the rate of $ per mile and the reimbursed 30 cents per mile from your employer. In , the rate is 67 cents per mile, the highest it's ever been. This is cents higher than it was in , at cents per mile. CRS states that on and after January 1, , state officers and employees shall be allowed mileage reimbursement of 90% of the prevailing IRS rate. IRS Mileage Rates · IRS Business Mileage Rates · IRS Charitable Mileage Rates · IRS Medical Mileage Rates · IRS Moving Mileage Rates. This guide will walk you through the complete list of the IRS mileage rates, what counts, what doesn't count, and how to keep a record for compliance. The state fleet mileage reimbursement rate reflects the average cost of operating a mid-size sedan in the state vehicle fleet. Due to soaring gas prices, the IRS announced a rare midyear increase in the standard mileage rate for the final six months of —to cents per. The IRS has set the latest standard mileage rate at cents per business mile. Table of contents. What is mileage tax deduction?. Standard mileage. Multiply your business miles driven by the standard rate. For , the rate is $ per mile. This rate includes driving costs, gas.

2fa Sms Hack

It allows attackers to intercept text messages containing OTPs sent by users. There are various ways to do it: hacking into mobile networks or intercepting them. Although having some form of 2FA is better than having none at all, the Reddit hack serves as a huge reminder that phone-based authentication lacks one major. Can two-factor authentication be hacked? We now know how 2FA prevents hacking, but can hackers get past 2FA? The short answer: Yes, 2FA can be bypassed by. 2. Social Engineering: Deceptive tactics like phishing emails or phone calls can trick you into revealing your received code to a hacker posing. Two-factor authentication · the attacker gains access to SMS data (sim hijacking) when the code is sent via text · the victim doesn't employ 2FA. The business Gmail accounts of the chief executive of Cloudflare were hacked in this way. Although SMS-based 2FA is inexpensive, easy to implement and. SIM card hacking software is cheap. You may think that software and equipment that's needed to hack a SIM card is expensive, but it's not true – anyone can buy. Most MFA solutions have had exploits published which temporarily exposed opportunities for hacking (eg. a red team research team recently exposed a. View The Email to Get Hacked: Attacking SMS-Based Two-Factor Authentication · Figures and Tables · Topics · 8 Citations · 18 References · Related Papers. It allows attackers to intercept text messages containing OTPs sent by users. There are various ways to do it: hacking into mobile networks or intercepting them. Although having some form of 2FA is better than having none at all, the Reddit hack serves as a huge reminder that phone-based authentication lacks one major. Can two-factor authentication be hacked? We now know how 2FA prevents hacking, but can hackers get past 2FA? The short answer: Yes, 2FA can be bypassed by. 2. Social Engineering: Deceptive tactics like phishing emails or phone calls can trick you into revealing your received code to a hacker posing. Two-factor authentication · the attacker gains access to SMS data (sim hijacking) when the code is sent via text · the victim doesn't employ 2FA. The business Gmail accounts of the chief executive of Cloudflare were hacked in this way. Although SMS-based 2FA is inexpensive, easy to implement and. SIM card hacking software is cheap. You may think that software and equipment that's needed to hack a SIM card is expensive, but it's not true – anyone can buy. Most MFA solutions have had exploits published which temporarily exposed opportunities for hacking (eg. a red team research team recently exposed a. View The Email to Get Hacked: Attacking SMS-Based Two-Factor Authentication · Figures and Tables · Topics · 8 Citations · 18 References · Related Papers.

Using more than one authentication factor helps prevent a hacker from One of the most common 2FA methods uses SMS or text messages. Once you have. In recent times, SMS-based 2FA has come under scrutiny due to its susceptibility to various hacking techniques. As we explore the vulnerabilities in this. Safe. Even if a hacker will be trying to hack your account by solving this one-time password after a certain number of unsuccessful attempts the entrance to. In this article, we'll delve into the limitations of SMS-based 2FA and explore the evolving tactics hackers use to defeat it. • Not perfect, but stops easy SIM-swapping attacks. MFA Hacks. Page Hacking Into Your Email Using Recovery Methods. SMS Rogue Recovery Hack. • There is an. Go to channel My Google account was hacked with 2-step-verification turned on & how I recovered it! Confirming the identity via phone limits the possibility of hacking the account by a person who maybe even knows the username and password – but won't be able. Email is more secure for two-factor authentication. There are known hacks of SMS. In fact,it's better to not use SMS and use email or an. While 2FA seems great, there are many conditions that come with it that doesn't make it “hacker-proof”. Why 2FA Doesn't Make You Hack Proof? There is one type. According to Verizon's Data Breach Report, password abuse is still responsible for 70% of all hacks and there is broad consensus that the use of Multi-Factor. A hacker's primary goal is to find vulnerabilities and utilize tactics to bypass security measures. While some hackers are white hat—meaning they are employed. In the past, hacking SMS was a little more involved for attackers. There was the SS7 exploit where a hacker could exploit weaknesses in the. Unable to recognize the hacker's computer, the bank might then ask them to verify their identity via SMS. Using the SS7 hack, the hacker could then intercept. The numbers suggest that users who have 2FA enabled blocked about % of automated attacks. But like any other good cyber security solution, an attacker can. Discover how ChatGPT helped me become a hacker, from gathering resources to tackling CTF challenges, all with the power of AI. Jun Hacking the hacker. I tested the system together with Hacker editor Andrei Vasilkov who played the role of an extremely naive victim. Although the address of my. So starting today, we will no longer allow accounts to enroll in the text message/SMS method of 2FA unless they are Twitter Blue subscribers. The availability. It's a loss from the business' perspective. They could support 2FA with SMS and check a box; to additionally support it with TOTP would only be additional cost. Discover how ChatGPT helped me become a hacker, from gathering resources to tackling CTF challenges, all with the power of AI. Jun When you turn on two-factor authentication, you're asked to choose either a security key, text message (SMS) codes or a third-party authentication app as.

How To Send Digital Art Commissions

To sell art commissions, artists often use a slot system, usually in the form of a “counter” in their display name. · To increase transparency to clients. aerroscape digital art · english | IMAGINATION OF NATURE · deutsch | FANTASIE artworks or if you have any other questions, please email me: E-Mail. Our carefully crafted digital art commission form can help you collect essential information, easing communication and ensuring a smooth transaction. FULL-BODY PORTRAIT. $ Single character. Simple/plain background. Full colour digital painting. ADD TO YOUR COMMISSION: Detailed background = $ All of my digital commissions are created in Adobe Photoshop or Adobe Illustrator at print resolution, and are printed onto matte fine-art paper with a slight. Check in periodically, and send them some photos of work in progress, or an enthusiastic update. I can't stress the enthusiasm enough: YOU are the artist. If. but for digital artists you have a lot more options available to you. and I as well as many other digital artists kind of use a mixture of delivery options. for. Quote. Request a free, no-obligation price estimate and confirm final details. · First Payment. Receive PayPal Invoice and send first payment. · Artwork Created. art, commissions, artist, 2d, digital-art · kinboo_shii (nero) April 29, , am #3. Sorry for being late ack ;; I'll send it via PMs! 1 Like. To sell art commissions, artists often use a slot system, usually in the form of a “counter” in their display name. · To increase transparency to clients. aerroscape digital art · english | IMAGINATION OF NATURE · deutsch | FANTASIE artworks or if you have any other questions, please email me: E-Mail. Our carefully crafted digital art commission form can help you collect essential information, easing communication and ensuring a smooth transaction. FULL-BODY PORTRAIT. $ Single character. Simple/plain background. Full colour digital painting. ADD TO YOUR COMMISSION: Detailed background = $ All of my digital commissions are created in Adobe Photoshop or Adobe Illustrator at print resolution, and are printed onto matte fine-art paper with a slight. Check in periodically, and send them some photos of work in progress, or an enthusiastic update. I can't stress the enthusiasm enough: YOU are the artist. If. but for digital artists you have a lot more options available to you. and I as well as many other digital artists kind of use a mixture of delivery options. for. Quote. Request a free, no-obligation price estimate and confirm final details. · First Payment. Receive PayPal Invoice and send first payment. · Artwork Created. art, commissions, artist, 2d, digital-art · kinboo_shii (nero) April 29, , am #3. Sorry for being late ack ;; I'll send it via PMs! 1 Like.

A full payment needs to be done before any progress on the artwork. · All commissions are sent as the final version of the piece, exploration sketches/sketch. art is exactly how you want it on the wood before any burning begins. Court will create and send you a digital draft image of the custom artwork on your. We have experience with custom paintings, sculptures, digital art projects, prints for wallpapers and hoarding walls, and more. This group is simply about connecting people who wish to commission or purchase unique pieces of visual art with the artists who create them. If you are uncomfortable with money upfront, you can ask 50% upfront, then the 50% after finishing. (Again, deliver the final artwork only after payment's been. MyArtBrief allows you to find and commission an artist to create art for you with a click of a button. Get the digital art commission form you've always wanted with Jotform's free online form builder. Upload your logo, change the colors of the background, add. Are you currently accepting commissions? What are your price ranges for commissions? How do commissions work? What can I expect when I order a commission? Brazil Illustrator & Graphic Designer Comic Artist & Editor Currently making Digimon arts. This is how I paint #digitalart #tutorial #Tips. Image. I've made a post about my commissions, but this is an Emergency Commission post. I have tried for long and hard to apply for jobs to earn some income for. Art Commissions Guide · 1. Inform your client about your art making process · 2. Clients who commission artwork usually have no idea what they want · 3. Write a. art, additional characters, or if you'd like it in a larger format (these require more work, and would cost more.) I don't usually send a sketch/WIP. Headshot Icon Portrait: PHP pesos or 4$ only! MOP: GCASH & PAYPAL TAT: Days (Will send updates such as sketch) 5 Slots only and for now 2/. way to send you money online. What are the positives of using an online If you are offering services such as bespoke work or commissions, check out service-. Make it known on your artist Instagram account, your artist website or signage at an art fair. You'll also want to have a professional portfolio of work to. If you want NSFW please add a $3 tip to your order and put "NSFW Add on" to the personalization. If you'd like NSFW examples, message me! Once the artwork is. Set your budget, describe your perfect artwork and set a completion date. Your chosen artist will then accept your offer or contact you via Artfinder messenger. Get paid for your digital art commissions quicker and cheaper – without changing how you find clients. Step 1: Start a new commission on Arty with the details. Launch commission junction cj affiliate program and customization · Draw anime art commissions · Commission people and furry · Draw an art commission · My art.

2019 Tesla Model 3 Insurance Cost

Many providers base your premium on information that has little to do with your driving. Learn more about Tesla Insurance or use the Tesla app to get a quote. A Model 3 costs approximately $3, to insure per year. A Model X costs about $4, to insure per year. These averages from were derived from quotes. Auto insurance for a Tesla Model 3 will cost about $2, per year. This is more than the national average for luxury sedan models by $ The average Tesla car insurance rates are $2, per year, based on our customer data. Tesla's higher insurance premiums are attributed to higher sticker prices. Average annual premium by model ; Tesla Model Y · $2, ; Tesla Average. $2, ; Tesla Model S · $2, ; Tesla Model 3. $3, Tesla's overall warranty coverage is among the longest in the EV Tesla Model 3 Long Range Vehicle Type: front- and mid-motor, all-wheel. Capital Insurance Group, $1, / year. Tesla Model 3 Insurance. Average Cost to Insure. $ / year. Cheapest Rate. $ / year Mercury Insurance. The cost of insurance for a Tesla Model 3 is $, according to data from spark-servis.ru However, individual rates can differ based on your car's model year and the. Tesla Model 3 insurance costs range from $ to $ per month; Allied offers the cheapest coverage; See more average rates from GEICO, Allstate. Many providers base your premium on information that has little to do with your driving. Learn more about Tesla Insurance or use the Tesla app to get a quote. A Model 3 costs approximately $3, to insure per year. A Model X costs about $4, to insure per year. These averages from were derived from quotes. Auto insurance for a Tesla Model 3 will cost about $2, per year. This is more than the national average for luxury sedan models by $ The average Tesla car insurance rates are $2, per year, based on our customer data. Tesla's higher insurance premiums are attributed to higher sticker prices. Average annual premium by model ; Tesla Model Y · $2, ; Tesla Average. $2, ; Tesla Model S · $2, ; Tesla Model 3. $3, Tesla's overall warranty coverage is among the longest in the EV Tesla Model 3 Long Range Vehicle Type: front- and mid-motor, all-wheel. Capital Insurance Group, $1, / year. Tesla Model 3 Insurance. Average Cost to Insure. $ / year. Cheapest Rate. $ / year Mercury Insurance. The cost of insurance for a Tesla Model 3 is $, according to data from spark-servis.ru However, individual rates can differ based on your car's model year and the. Tesla Model 3 insurance costs range from $ to $ per month; Allied offers the cheapest coverage; See more average rates from GEICO, Allstate.

Take care of your Tesla Model 3 by getting the right car insurance cover and explore this model's features in Compare the Market's comprehensive guide. Tesla Tesla Model X Insurance Rates by Companies ; Buckeye Insurance Group, $1, / year ; Penn National, $2, / year ; Central Mutual Insurance Co. See the different options California customers have with Tesla Insurance. article. Driving. Ownership. Tesla App. Model S. Model 3. Model X. Model Y. Vehicle. Tesla Model 3 insurance costs between $1, and $4, annually, assuming you have a good driving record. While Tesla Model 3 is the cheapest model in Tesla's. See how much a car insurance policy can cost for a TESLA MODEL 3; our clients saved on average $ to insure their vehicle. See how much a car insurance policy can cost for a TESLA MODEL 3 ; our clients saved on average $ to insure their vehicle. Average annual premium for full coverage by model ; Tesla Model 3 · Auto-Owners, $, $1, USAA ; Tesla Model X · USAA, $, $2, Erie ; Tesla Model Y · Auto-. If you're considering purchasing a Tesla Model 3, it's important to also consider the cost of insuring it. According to estimates from insurance. Tesla Model S drivers can expect to pay about $ per month for their auto insurance, if you look at average rates across the US. Based on our research, Tesla Model 3 owners pay an average of $ for full-coverage insurance. Of course, remember that your costs will differ since insurance. Average Tesla insurance costs can vary. Based on our customer quote data, the average price of Tesla car insurance is $2, per year or about $ monthly. coverage that gives you peace of mind. How much does car insurance for a Tesla Model 3 cost? A great rate on auto insurance is just a few clicks away. Start. Discover the cost of car insurance for a Tesla Model 3 and explore insurance rates, crash safety ratings, and more. Get a quote today from GEICO. After all, vehicle battery range and charging options improve yearly. Combine that with the variety of electric vehicle models and it's becoming a viable option. The average monthly premium to insure the Tesla Model 3 is $ a month for standard coverage and $24 a month for minimum coverage. The best monthly payment is. Based on our research, Tesla Model 3 owners pay an average of $ for full-coverage insurance. Of course, remember that your costs will differ since insurance. How much does it cost to insure a Tesla? · Model 3: $2, · Model S: $3, · Model X: $3, · Model Y: $3, Nerd Wallet points out that the model 3 car insurance cost is almost 40% higher than the national average car insurance cost. Let's look at how Nerd Wallet. Tesla Model S Insurance cost · Average insurance premium: $ per month · Most affordable company: Allied ($94 per month) · 41% of drivers insure their Model S. I quoted a Tesla Model 3. Your rates will depend on where you live, how many miles per year you drive, your age, multi-policy discounts and more. So, for.

Hashgraph

An online course created by The Hashgraph Association and Swirlds Labs to create a path for those looking to build on the Hedera Hashgraph network. How to accept Hedera Hashgraph payments? First, you need to sign up for a NOWPayments account. The process shouldn't take more than a minute! Go to Store. Hashgraph (formerly @SwirldsLabs) supports @Hedera's growth to accelerate ecosystem builders' time to market. Hedera Hashgraph is not just another blockchain; it is a public distributed ledger technology platform built on a revolutionary consensus mechanism called. What is Hedera Hashgraph and should you buy it? CryptoVantage gives you everything you need to know and how to buy. HBAR Foundation Commits $M to Drawing Metaverse Apps to Hedera. Hedera Hashgraph, known for its blockchain-like distributed ledger technology (DLT), will put. Hedera operates using a consensus mechanism known as hashgraph. This consensus algorithm is designed to allow Hedera to process and execute transactions faster. Hashgraph is a superior consensus mechanism / data structure alternative to blockchain. - hashgraph/awesome-hashgraph. Hashgraph Vs Blockchain On the other hand, Hedera Hashgraph is also a distributed ledger technology that works on the above data structure and a better. An online course created by The Hashgraph Association and Swirlds Labs to create a path for those looking to build on the Hedera Hashgraph network. How to accept Hedera Hashgraph payments? First, you need to sign up for a NOWPayments account. The process shouldn't take more than a minute! Go to Store. Hashgraph (formerly @SwirldsLabs) supports @Hedera's growth to accelerate ecosystem builders' time to market. Hedera Hashgraph is not just another blockchain; it is a public distributed ledger technology platform built on a revolutionary consensus mechanism called. What is Hedera Hashgraph and should you buy it? CryptoVantage gives you everything you need to know and how to buy. HBAR Foundation Commits $M to Drawing Metaverse Apps to Hedera. Hedera Hashgraph, known for its blockchain-like distributed ledger technology (DLT), will put. Hedera operates using a consensus mechanism known as hashgraph. This consensus algorithm is designed to allow Hedera to process and execute transactions faster. Hashgraph is a superior consensus mechanism / data structure alternative to blockchain. - hashgraph/awesome-hashgraph. Hashgraph Vs Blockchain On the other hand, Hedera Hashgraph is also a distributed ledger technology that works on the above data structure and a better.

Experience rapid dApps Development with the Hashgraph Application Studio – an innovative fusion of Hedera and Joget no-code/low-code platform. Hedera Hashgraph is a cryptocurrency network designed to enable secure transactions and deploy applications, but with a twist — it's. Hedera Hashgraph, hedera is the most used enterprise-grade public network for you to make your digital world exactly as it should be. The current price of Hedera Hashgraph (HBAR) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking. Hashgraph Director of Product Management Keith Kowel is joined by Senior Director of Product Management Doug van Kohorn to discuss upcoming Hedera Improvemen. Hedera Hashgraph is a A sustainable, enterprise-grade public network. Chainlink Ecosystem delivers the latest news and information about integrations and. As compared to other platforms, Hedera Hashgraph stands out unique regarding its high-speed performance, enhance security and fair conditions. Moreover, it does. An online course created by The Hashgraph Association and Swirlds Labs to create a path for those looking to build on the Hedera Hashgraph network. Hedera Hashgraph Development Services. We believe in delivering fast, fair, and secure applications based on Hedera's network services, such as cryptocurrency. We are a blockchain development company that specializes in creating decentralized applications on the Hedera Hashgraph technology that are fast, scalable. What is Hashgraph? Hashgraph is the first asynchronouse byzantine fault tolerant (aBFT) consensus algorithm that results in fair ordering, fast finality, and. What is Hashgraph? Hashgraph is the first asynchronouse byzantine fault tolerant (aBFT) consensus algorithm that results in fair ordering, fast finality, and. 25K Followers, 92 Following, 18 Posts - Hedera (@hashgraph) on Instagram: "Hedera is the open source, leaderless proof-of-stake network powering the next. A W3CB Certified Hedera Hashgraph developer course graduate demonstrates the knowledge to develop and maintain client applications using the latest Hedera. Contribute to Hedera Improvement Proposals. Learning center. Resources on DLT and how hashgraph works. Reduce cost and unlock new revenue. Tokenized Assets. Hedera Hashgraph is a public distributed ledger for building decentralized applications. Hedera Hashgraph Coin Cryptocurrency HBAR crypto Notebook: Transaction Log Ledger, Air Drop Tracker, Passwords Book for New and Experienced Traders 6x9 Rapid is a leading Hedera Hashgraph development business that provides sophisticated features and consulting services for unique enterprise-level DApps that. Hedera Hashgraph have raised a total of $ M in 9 completed rounds: Token Launch, Private and 7 more At the moment Market Cap is $ B, HBAR Token. Track Hedera Hashgraph price today, explore live HBAR price chart, Hedera Hashgraph market cap, and learn more about Hedera Hashgraph cryptocurrency.

Mlps Tax

/shutterstock_180080393-5bfc3654c9e77c0026b72e81.jpg)

At year-end you will receive Form K-1 from the MLP, which allocates income based on your ownership percentage. Since these MLPs operate in a capital-intensive. Master limited partnerships (MLPs) can offer high dividend yields, steady cash flow, tax advantages, and the potential for capital appreciation. Secondly, the MLP is able to claim a variety of deductions that cause some or all of the distribution to be treated as a tax-deferred (but not tax-free) return. IRS requires that these benefits be recaptured as ordinary income upon sale of MLP units. In a simplistic example, if an MLP holder bought units at $10 and. While this strategy offers significant tax advantages it's important to remember that MLPs like any investment have their drawbacks. Renowned MLP Investments. The real question is whether or not you want to place them in an IRA. Given their already ingrained tax advantages, MLPs are best suited as taxable accounts. An MLP, like all partnerships, is a pass-though entity which pays no tax itself. It is treated by the tax code not as a separate entity but as a collection of. Creating tax efficient structures for MLPs and advising potential and existing MLPs on the qualification of MLP income under the qualifying income rules of. As a partnership, an MLP does not pay entity-level income tax, therefore enabling it to distribute more cash flow to the unit holders. At year-end you will receive Form K-1 from the MLP, which allocates income based on your ownership percentage. Since these MLPs operate in a capital-intensive. Master limited partnerships (MLPs) can offer high dividend yields, steady cash flow, tax advantages, and the potential for capital appreciation. Secondly, the MLP is able to claim a variety of deductions that cause some or all of the distribution to be treated as a tax-deferred (but not tax-free) return. IRS requires that these benefits be recaptured as ordinary income upon sale of MLP units. In a simplistic example, if an MLP holder bought units at $10 and. While this strategy offers significant tax advantages it's important to remember that MLPs like any investment have their drawbacks. Renowned MLP Investments. The real question is whether or not you want to place them in an IRA. Given their already ingrained tax advantages, MLPs are best suited as taxable accounts. An MLP, like all partnerships, is a pass-though entity which pays no tax itself. It is treated by the tax code not as a separate entity but as a collection of. Creating tax efficient structures for MLPs and advising potential and existing MLPs on the qualification of MLP income under the qualifying income rules of. As a partnership, an MLP does not pay entity-level income tax, therefore enabling it to distribute more cash flow to the unit holders.

How Are Master Limited Partnerships Classified? By distributing more than 90% of its income the partnership avoids double taxation, which occurs when tax is. MLPs have more attractive tax characteristics than corporations that are subject to double taxation from the view point of shareholders. The most common. This arrangement avoids the “double taxation” that investors in corporations face, as MLP earnings are only taxed once at the unit holder level. Taxes Paid on. ** The IRS may assert that Section applies to ETNs, causing tax exempt and tax deferred investors to have UBTI as if it directly invested in MLPs. Page 2. MLPs, on the other hand, do not pay tax at the entity level if they meet special “qualifying income” requirements. MLPs are pass-through entities that are taxed as a partnership for federal income tax purposes, avoiding the double taxation of corporations (see Practice. The legislation is a powerful tweak to the federal tax code that could unleash significant private capital into the energy market. It would level the playing. To address the challenges faced by our MLP clients, PwC created a specialized team of tax, capital markets, valuation, advisory and audit professionals. Our MLP. The authors are indebted to Gail Moglin of IRS' Statistics of Income and her contacts in. IRS field offices for collecting tax returns of master limited. Investors often ask if they can invest in MLPs through their retirement accounts – IRAs, (k)s, and similar plans which are allowed to earn tax-deferred. MLPs pay distributions rather than dividends. A PORTION OF DISTRIBUTIONS ARE TAX DEFERRED UNTIL. INVESTMENT IS SOLD. Cash distributions usually exceed the. the term used in the tax code. • Simply, it is a partnership, or a limited liability company. (LLC) that has chosen partnership taxation. How master limited partnerships work. An MLP is a business structure that is taxed as a partnership, but whose ownership interests are traded like corporate. changes in tax treatment could negatively impact the value of an investment in an MLP. Concentration risk: Many MLPs are concentrated in the energy. It combines the tax benefits of a partnership with the liquidity of publicly traded securities. To obtain the tax benefits of a pass through, MLPs must generate. Master Limited Partnerships (MLPs) are becoming more and more popular investment options. When you sell your interest in an MLP, the tax reporting can be. Master limited partnerships (MLPs) are entities that combine the tax benefits of a private partnership with the liquidity advantages of a stock. Treatment of an MLP as a partnership for federal income tax purposes requires that 90 percent or more of the MLP'sgross income for every taxable year consists. MLP issuers in their ongoing corporate and securities work and tax planning. Baker Botts Corporate MLPs stats Our lawyers provide sound, creative advice.

1 2 3 4 5