spark-servis.ru

News

Average Apr For Home Improvement Loan

The best home improvement loans overall are from LightStream. The company offers loan amounts up to $,, an APR range of % - %, repayment periods. Home improvement loans are typically unsecured, meaning you won't use your home as collateral. Interest rates on home improvement loans are fixed and usually. APR is Annual Percentage Rate. Normal credit criteria apply. Rates for approved loans are based on the applicant's credit history. Stated “rates as low as”. Personal loan APRs through Prosper range from % to %, with the lowest rates for the most creditworthy borrowers. Eligibility for personal loans up to. For Personal Loans, APR ranges from % to % and origination fee ranges from % to % of the loan amount. APRs and origination fees are determined. Receive a home improvement loan in 1–4 business days. Secure financing for all of your home improvement needs. Rates from %% APR based on credit. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Your APR will be between % and % based on creditworthiness at time of application for loan terms of months. For example, if you get approved for. Annual Percentage Rate (APR). % - %* APR with AutoPay · Loan purpose. Debt consolidation, home improvement, auto financing, medical expenses, and others. The best home improvement loans overall are from LightStream. The company offers loan amounts up to $,, an APR range of % - %, repayment periods. Home improvement loans are typically unsecured, meaning you won't use your home as collateral. Interest rates on home improvement loans are fixed and usually. APR is Annual Percentage Rate. Normal credit criteria apply. Rates for approved loans are based on the applicant's credit history. Stated “rates as low as”. Personal loan APRs through Prosper range from % to %, with the lowest rates for the most creditworthy borrowers. Eligibility for personal loans up to. For Personal Loans, APR ranges from % to % and origination fee ranges from % to % of the loan amount. APRs and origination fees are determined. Receive a home improvement loan in 1–4 business days. Secure financing for all of your home improvement needs. Rates from %% APR based on credit. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. Your APR will be between % and % based on creditworthiness at time of application for loan terms of months. For example, if you get approved for. Annual Percentage Rate (APR). % - %* APR with AutoPay · Loan purpose. Debt consolidation, home improvement, auto financing, medical expenses, and others.

Current APR s range from % to % APR. Loans are available in the amounts of $10, to $75, Terms lengths of up to 84 months available. Credit and. Searching for a loan with a low APR, manageable monthly payment, and lighting-fast funding? Access our lowest rates available with a Secured Loan, our product. Rates are based on a combined loan-to-value (CLTV) up to %. A typical Home Equity Plus Loan of $10, at % APR would have 60 monthly payments of. Quick access to funds, 5 – 7 day average. Make every day at home more enjoyable * APR = Annual Percentage Rate. Offer of credit is subject to credit. Rates range from % to % Annual Percentage Rate (APR)Footnote 6, which includes a relationship discount of %. No origination fee or prepayment. 19, the average rate on a home equity loan was %, a decline from the previous week's rate of %. The average rate on year fixed home equity loans also. SpeedNormal. Debug Our standard installment loans feature affordable monthly payments and competitive interest rates for your prime credit customers. Subject to credit approval. Conditions and limitations apply. Rates and terms are subject to change without notice. Minimum loan amount is $2, and. $50, project · with a year term · with a credit score · at a % fixed interest rate. Hi, I am wondering what is a good target interest rate to look for with a 23K home improvement loan. My credit score is , income 78K. HELOC rates are 9%% today. Assuming that the loan type is installment rather than revolving, it sounds like a fair deal. I'd be concerned if. Overall, Navy Federal offers competitive rates on home improvement loans, especially those with terms under three years in length. Loans up to 36 months come. We list current Mountain View HELOC & home equity loan rates to help you perform your calculations and find a local lender. Payments Qualify Rates. Estimate. List of improvements or work estimates. Loan may not exceed the total amount of improvement estimates provided by the member. Rates Effective: 8/21/ The rates and satisfaction ratings below are from our Home Improvement Loans survey. Credit Score, Satisfaction*. Excellent, Good, Average, Bad, Poor. – Interest rates: % to %. Loan amounts: $5, to $, Repayment terms: 2 to 7 years. Discounts: Autopay (%), existing account holder (%). HFS Financial offers the easiest home improvement financing and swimming pool loans with up-front funding. You Dream It, We Finance It. And more than half of the survey participants indicated they had a new renovation project in the planning stage. According to Houzz, the median cost per project. 1 Personal Loans Rate and Terms Disclosure: Rates for personal loans provided by lenders on the Credible platform range between % – %. APR with terms. These types of loans typically have higher interest rates, compared to loans secured by the value of your home. Average costs of home renovation projects vary.

Do I Qualify For The Next Stimulus Check

Incarcerated people are eligible for the stimulus payment if they meet the eligibility guidelines. You should have received an automatic payment if you: Filed. Part of that package granting qualifying individuals and families a one-time stimulus payment of up to $ To see if you qualify for the payment, check out. Eligibility & Amount · are a U.S. citizen or U.S. permanent resident; · are not a dependent of another taxpayer; and · have adjusted gross income (AGI) that is not. What if I am married to someone who owes child support, will my tax return be applied to the child support arrears they may owe? Yes, unless you are eligible. You never have to pay money or reveal banking information to receive or qualify for stimulus payments. Don't respond to robocalls about stimulus checks – these. Use the IRS Non-Filers Tool spark-servis.ru to check your eligibility and file for this payment. Use this tool if you. In order to receive a stimulus payment, you must have an Adjusted Gross Income (AGI) in that is under $99, (single filer) and $, (joint filers). The payments would amount to $1, for each dependent child. Eligible families will get a $1, payment per qualifying dependent claimed on their tax return. Use the calculator below to see how large a check you'll receive. If you've already filed your taxes, the check will most likely be based on that income. Incarcerated people are eligible for the stimulus payment if they meet the eligibility guidelines. You should have received an automatic payment if you: Filed. Part of that package granting qualifying individuals and families a one-time stimulus payment of up to $ To see if you qualify for the payment, check out. Eligibility & Amount · are a U.S. citizen or U.S. permanent resident; · are not a dependent of another taxpayer; and · have adjusted gross income (AGI) that is not. What if I am married to someone who owes child support, will my tax return be applied to the child support arrears they may owe? Yes, unless you are eligible. You never have to pay money or reveal banking information to receive or qualify for stimulus payments. Don't respond to robocalls about stimulus checks – these. Use the IRS Non-Filers Tool spark-servis.ru to check your eligibility and file for this payment. Use this tool if you. In order to receive a stimulus payment, you must have an Adjusted Gross Income (AGI) in that is under $99, (single filer) and $, (joint filers). The payments would amount to $1, for each dependent child. Eligible families will get a $1, payment per qualifying dependent claimed on their tax return. Use the calculator below to see how large a check you'll receive. If you've already filed your taxes, the check will most likely be based on that income.

Stimulus Details:CO residents could claim up to $ per qualifying person by filing a Return by October 17, - married couples could receive $1, The government sets eligibility requirements for stimulus checks, which means not everyone is entitled to receive them. Stimulus checks were used during the. Do I have to apply to receive the payment? Most eligible U.S. taxpayers will next spring. The act also raises the Child and Dependent Care Tax. $, if filing as head of household;; $, for couples filing jointly. Check your eligibility with Maine Revenue Services: [link coming soon]. How Can I. There is no minimum income needed to qualify for the payment. Households with adjusted gross income (AGI) up to $75, for individuals (up to $, if. Did not file taxes in or If you or your spouse had any earned income in. , you should likely be filing taxes, not registering as a non-filer. Eligible residents have already received their stimulus checks (called Economic Impact Payments), and there is no current plan to issue another round of. The IRS will determine eligibility based on the most recent tax return they have processed, either or If your eligibility for the first two payments. Relief payments or $ or $1, for New Mexicans who do not qualify for the rebates above. Will the check be going out to Seniors on SSI? A: New. How do I know if I qualify? To qualify you must: Be a current low-income New If an applicant does not provide banking information a check will be mailed to. If you missed the October filing deadline, you can still file your tax return to get your first and second stimulus checks. If you don't owe taxes, there. However, if that changed in and you met the other eligibility requirements, you can claim the credit on your federal tax return (which you file in. Adults who earned less than $75, should have received a full payment, with reduced payments to those earning up to $80,; married couples who earned up to. U.S. citizens and permanent residents can use this tool if they had gross income that did not exceed $12, ($24, for married couples filing jointly) for. The government sets eligibility requirements for stimulus checks, which means not everyone is entitled to receive them. Stimulus checks were used during the. The maximum amount for the third round of stimulus checks would be $1, for any eligible individual or $2, per eligible couple filing taxes jointly. · Each. Are Noncitizens Eligible? Back in March, the CARES Act did not allow families of mixed-status to receive a stimulus check. This refers to households in which a. Keep reading to learn more about the eligibility requirements and how to check the status of your Surplus Refund. decorative image. How Do I Learn More. You can be eligible even if you have low income, no income, or don't usually file taxes. You can get this money even if you have never filed taxes or have not. Eligible taxpayers must have filed their individual income tax return by November 1, to receive the rebate. Check Your Eligibility. Do you need to pay.

Banks That Do Not Charge Foreign Transaction Fees

Capital One has a particularly good reputation for no-fee international transactions on both its credit cards and its debit cards linked to a checking account. Most issuing banks do not charge international transaction fees on their travel credit cards. For Business Owners. Capital One Savor One. No foreign transaction fees. No annual fee. Financial institutions charge various kinds of fees for their services, some you may not How to avoid it: Not all banks charge foreign transaction fees. Bank customers when using their debit or prepaid card to withdraw cash. When you use an ATM not owned by us, you may be charged a fee by the ATM operator or. When you use your credit or debit card in a foreign country, or online with a foreign merchant, your card issuer, usually a bank, may charge a foreign. Find no foreign transaction fee credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits. The Capital One VentureOne Rewards Credit Card is the best no-annual-fee travel card with no foreign transaction fees, as it's the most rewarding option. Capital One has cards without foreign transaction fees. You can go to the WalletHub website, check the boxes that fit your criteria, compare the. Capital One has a particularly good reputation for no-fee international transactions on both its credit cards and its debit cards linked to a checking account. Most issuing banks do not charge international transaction fees on their travel credit cards. For Business Owners. Capital One Savor One. No foreign transaction fees. No annual fee. Financial institutions charge various kinds of fees for their services, some you may not How to avoid it: Not all banks charge foreign transaction fees. Bank customers when using their debit or prepaid card to withdraw cash. When you use an ATM not owned by us, you may be charged a fee by the ATM operator or. When you use your credit or debit card in a foreign country, or online with a foreign merchant, your card issuer, usually a bank, may charge a foreign. Find no foreign transaction fee credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits. The Capital One VentureOne Rewards Credit Card is the best no-annual-fee travel card with no foreign transaction fees, as it's the most rewarding option. Capital One has cards without foreign transaction fees. You can go to the WalletHub website, check the boxes that fit your criteria, compare the.

Many banks and credit card issuers will charge domestic customers with foreign transaction Some cards do not charge any foreign transaction fees. MasterCard. The bank or network may also charge a fee. Schwab Bank does not assess foreign transaction fees (i.e., a fee to convert US dollars to local currency) to debit. If the customer brings their available balance to at least $0 before their Extra Time period expires, PNC will not charge the If International Money Transfer. You receive 3% cash back on eligible travel purchases and at restaurants. And all other purchases earn 1% cash back. This card does not charge any annual fees. Not all credit cards are a good choice for traveling abroad, as some charge a fee for purchases made in a foreign country or currency. Plus, with Visa Zero Liability2 we guarantee you won't be held responsible for unauthorized charges made with your card. This fee is fixed and not affected by things like how much of a balance you Foreign transaction fees are charged when you use your card in another. Many banks and credit card issuers will charge domestic customers with foreign transaction Some cards do not charge any foreign transaction fees. MasterCard. Find no foreign transaction fee credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits. Credit cards can help you to manage your spending abroad. The benefit of most credit cards that have been designed for travel is that they don't charge foreign. But there are no annual fee cards with no FX fees, too, like the Bank of America Travel Rewards credit card and the Wells Fargo Autograph Card. Get a debit card. Almost all Canadian debit and credit cards charge a currency conversion fee of at least %, the above are some of the exceptions. · Scotiabank and Tangerine. The Home Trust Preferred Visa Card is a secured credit card with the benefit of no foreign transaction fees. Rewards. Earn 1% cash back on all eligible. The NAB Platinum Visa Debit card doesn't charge an international transaction fee on purchase transactions processed overseas. It does charge an international. Indusind Banks's Visa Signature Exclusive Debit card has 0% foreign currency markup fee, 0% currency conversion fee, and 2% cash bank on all. Scotiabank Passport Visa Infinite Business card ($ Annual Fee); Wealthsimple Cash Card (Prepaid Card, no fees). All of the above cards except the Home Trust. Capital One cards and some Amex cards (I have the clear Everyday card, not sure about the others) don't charge foreign transaction fees. I agree with a previous. Annual fees: A card that doesn't charge foreign transaction fees may charge an annual fee, so consider that when choosing a credit card. Rewards: Consider. Some card issuers don't charge these fees or offer cards without a foreign transaction fee. With these cards, the card issuer may be covering the costs in an. No-Annual-Fee U.S. Credit Card with rewards and no foreign transaction feesLegal Disclaimer 4 on U.S. purchases. Get This Bundle in 5 Minutes Padlock %.

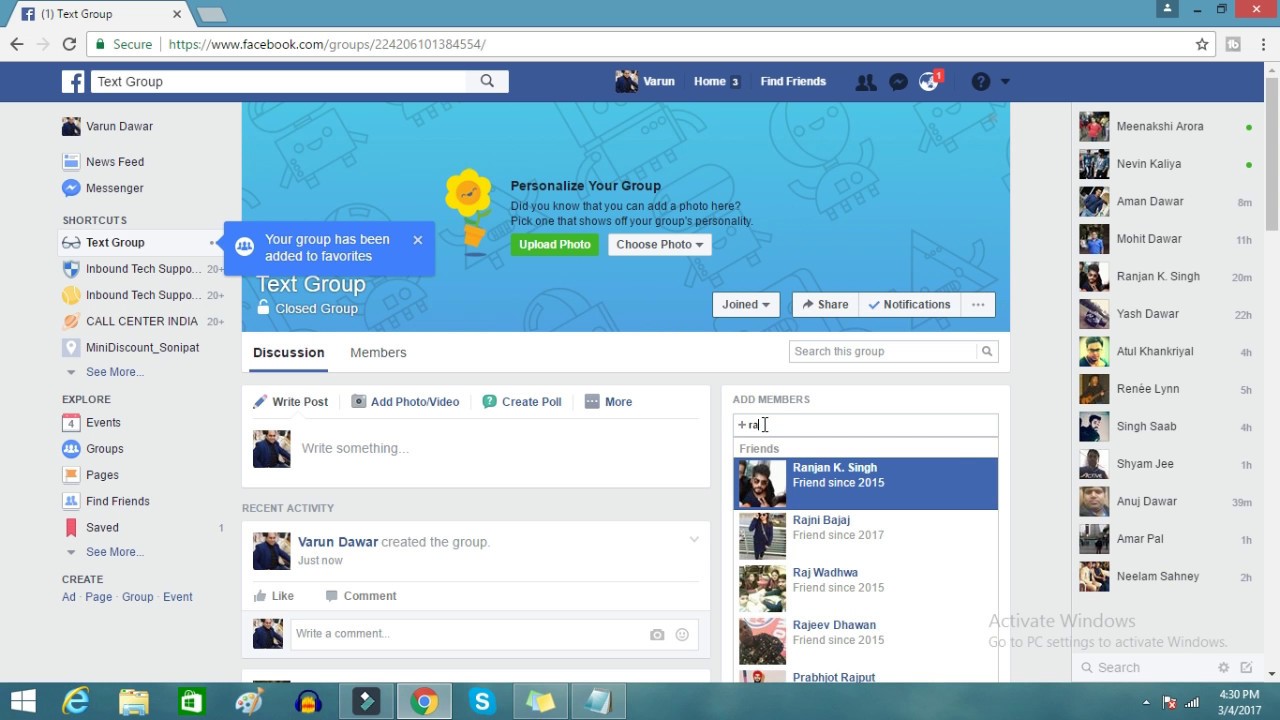

How To Make A Facebook Group A Business Page

You should create a new account with the name of your business and use it for promotion and posting on groups. You can create a business Facebook account together with FB business page and enter all of the relevant information about your company. Any Page can create and join groups. When you create a group from your Page, you can connect with customers and supporters in a more private forum and have. A personal Facebook profile: To create a Page, you need a profile. · Category: Select a category for your Page. · Information about your business · Goals you'd. You can search by topic (ex: marketing), your location, and even get very specific by typing in “Groups joined by people who like (an influencer's page name)”. Log into the account of your choosing, and then either click the Create a Page link or navigate to the Pages menu through your Facebook account. Facebook. In order to join a Facebook group as your page, they need to accept pages into their group. you can find this out in the search tab when you are. 1. From the left-hand panel of your Facebook home page select 'Groups', or from the drop-down list to the right of your notifications bell, select 'Create. 1. Log in to your Facebook account and click “Groups” from the menu on the left. · 2. Click the “+ Create Group” button in the top right corner. · 3. Type a name. You should create a new account with the name of your business and use it for promotion and posting on groups. You can create a business Facebook account together with FB business page and enter all of the relevant information about your company. Any Page can create and join groups. When you create a group from your Page, you can connect with customers and supporters in a more private forum and have. A personal Facebook profile: To create a Page, you need a profile. · Category: Select a category for your Page. · Information about your business · Goals you'd. You can search by topic (ex: marketing), your location, and even get very specific by typing in “Groups joined by people who like (an influencer's page name)”. Log into the account of your choosing, and then either click the Create a Page link or navigate to the Pages menu through your Facebook account. Facebook. In order to join a Facebook group as your page, they need to accept pages into their group. you can find this out in the search tab when you are. 1. From the left-hand panel of your Facebook home page select 'Groups', or from the drop-down list to the right of your notifications bell, select 'Create. 1. Log in to your Facebook account and click “Groups” from the menu on the left. · 2. Click the “+ Create Group” button in the top right corner. · 3. Type a name.

How To Promote Your Business In A Facebook Group · #1 Join the right Facebook groups. This is one of the biggest mistakes small businesses are making when using. Simple Steps to Convert Your Facebook Group to a Business Page · Creating the great audience for your page will be the next task that you should do. No doubt. You have a Facebook page for your business, but have you ever considered also creating a group? company's page on Facebook. In fact, many group owners. Add your business name and description. Name your Page after your business, or another name that people search for to find your business. · Add a profile photo. To create a group: 1. Tap in the top right of Facebook, then tap Groups. 2. Tap Create Group. 3. Enter your group name. 4. Select the privacy option. Personal Page/Profile: Private (can change setting to make some things public or only visible to certain people or groups of people). Business. 1: Click Groups on your company's Facebook homepage, which is on the left-hand side of the page. · 2: Click + Create New Group. · 3: Choose your group name. · 4. Facebook groups give Page owners a platform and tools to build an engaged, relevant community among existing and potential customers. Much like you should pay attention to what drives Facebook Page engagement, similar rules apply to your Group. For example, have you completely filled out your. Make a Page an admin of a Facebook group you manage · 1. Tap in the top right of Facebook, then tap Groups and select your group. · 2. Tap the group name below. Create a Page of the same name as your group. · Announce your Page in your group. · Lock your group so no one will post in it. · Select Group settings. · Below. Make a Page an admin of a Facebook group you manage. Dilema against FB community standards, in terms of FB group chat and bussiness page being able to comment in the chat. Create a Facebook group as your Facebook Page ; Classic Pages on Facebook are updating to the new Pages experience ; If you have Facebook access to your Page, you. If you are a beauty salon, for example, you can run a group (invite followers from your business page) and discuss different topics that may be of interest to. Your group should provide valuable tips for small business owners, like how their brand can make them stand out. Setting up a Facebook page is quite similar. Scroll down to the Linked Pages section, and choose your Page from the list to turn this personal group into a Business Page Group. Linking your Page will. Step 1: Know why you're deleting your Facebook Group. · Step 2: Prepare to delete your Facebook Group · Step 3: Choose a new platform for your Facebook Group. Facebook groups give Page owners a platform and tools to build an engaged, relevant community among existing and potential customers. One of the most important things here is to make sure that you are not just copy/pasting posts from your business page into your group - people will quickly.

Alumni Solutions

We offer value-added services and solutions for product launch and marketing, growth marketing, sales as a service and Website & Android Development. Read writing from Rocket Alumni Solutions on Medium. Rocket Alumni Solutions builds Touchscreen Software for Digital Walls of Fame, Touchscreen Hall of Fame. Rocket Alumni Solutions provides software for Touch Screen Athletic Awards, Hall of Fame, Wall of Honor, Digital Trophy Case, Interactive Awards Kiosk. Homecoming · Honored Alumni · Up-and-Coming Alumni · Spirit of Philanthropy Award · Spirit of Philanthropy & Homecoming Banquet · Wes Christiansen Memorial. As a Douglas alumnus, you have ongoing use of all services at the Career Centre, including access to staff with connections to employers. Today's classrooms are ever changing and so are the needs of both students and teachers alike. At Alumni we strive to meet these needs with new and. Alumni Planning Solutions, a Minority Business Enterprise (MBE) is a trusted environmental consulting and urban planning firm working in New York City and. The College of Health Solutions offers a range of graduate degree programs to equip students to make a positive difference in health and health care. Graduate. Rocket Alumni Solution's Digital Hall of Fame Wall is the gold standard of touch screen software. Engineered to evolve overtime and impress alumni, students. We offer value-added services and solutions for product launch and marketing, growth marketing, sales as a service and Website & Android Development. Read writing from Rocket Alumni Solutions on Medium. Rocket Alumni Solutions builds Touchscreen Software for Digital Walls of Fame, Touchscreen Hall of Fame. Rocket Alumni Solutions provides software for Touch Screen Athletic Awards, Hall of Fame, Wall of Honor, Digital Trophy Case, Interactive Awards Kiosk. Homecoming · Honored Alumni · Up-and-Coming Alumni · Spirit of Philanthropy Award · Spirit of Philanthropy & Homecoming Banquet · Wes Christiansen Memorial. As a Douglas alumnus, you have ongoing use of all services at the Career Centre, including access to staff with connections to employers. Today's classrooms are ever changing and so are the needs of both students and teachers alike. At Alumni we strive to meet these needs with new and. Alumni Planning Solutions, a Minority Business Enterprise (MBE) is a trusted environmental consulting and urban planning firm working in New York City and. The College of Health Solutions offers a range of graduate degree programs to equip students to make a positive difference in health and health care. Graduate. Rocket Alumni Solution's Digital Hall of Fame Wall is the gold standard of touch screen software. Engineered to evolve overtime and impress alumni, students.

Rocket Alumni Solutions, Boston, Massachusetts. 30 likes · 1 talking about this. The nation's leading Touchscreen Hall of Fame Community. Graduway alumni community platform allows you to boost engagement, drive event participation, build mentorship programs and more. Learn more here. ToucanTech · () · Smart software to power community engagement. ToucanTech platforms are purpose built for alumni managers, providing solutions to. 34 Followers, 6 Following, 7 Posts - Alumni Solutions (@alumnisolutions) on Instagram: "Infinite possibilities". Our Mission: To help high school and college administrators better recognize student, alumni, and community achievements. As a Telfer BCom or MBA recent alumni, you can benefit from services from the Telfer Career Centre. Whether you are looking for a job or getting ready to. Corporate Alumni software to enable lifelong relationships with former employees. Easily manage your corporate alumni program, creating new talent pools. Followers, Following, Posts - Rocket Alumni Solutions (@rocketalumnisolutions) on Instagram: " The nation's leading Touchscreen Hall of Fame. Find out what works well at Alumni Educational Solutions from the people who know best. Get the inside scoop on jobs, salaries, top office locations. Alumni are welcome to participate in all career services workshops and events. Additional services include the use of Handshake, an online job posting system. We have solutions for every type of learning space, from Early Education to High School, to upcoming spaces like E-Sports areas. Empower your former employees with access to their personal and payroll data through Zalaris Alumni Solution. With easy identity verification and helpdesk. Details Legal Name Rocket Alumni Solutions Inc. Rocket Alumni Solutions provides touchscreen recognition software for communities to honor their community. Alumni Planning Solutions, a Minority Business Enterprise (MBE) is a trusted environmental consulting and urban planning firm working in New York City and. The Youth Solutions Alumni Network creates a place where our program graduates can stay connected to each other and our organization, while receiving access. Rocket Alumni Solutions works with high school, college, and university athletic departments to display interactive touchscreen awards to highlight. Rocket Alumni Solutions's phone number is () What is Rocket Alumni Solutions's official website? Rocket Alumni Solutions's official website is www. Alumni Services · Cardinal Careers- is a subscription resource that is free to UofL alumni. · Career Fairs - all campus-wide career fairs. · Big Interview - a. Find out what works well at Alumni Educational Solutions from the people who know best. Get the inside scoop on jobs, salaries, top office locations. Increase Alumni Engagement & Philanthropy. The alumni engagement solution that helps universities improve alumni give back. Build alumni volunteerism and the.

How To Calculate Interest Of Loan

:max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

Step 1: Calculate the Daily Interest Rate. You first take the annual interest rate on your loan and divide it by to determine the amount of interest that. An annual percentage rate (APR) is a measure that's used to make it easier to understand how much borrowing money will cost. Free online calculator to find the interest rate as well as the total interest cost of an amortized loan with a fixed monthly payback amount. Interest is accrued daily and charged as per the payment frequency. Rates used for calculations are not considered rate guarantees or offers. Calculations. Assumes that the interest rate remains constant throughout the amortization period. All loans are subject to B2B Bank approval and the calculations shown may. L = loan amount r = interest rate, if floating rn is the interest rate in year n n = tenor of the loan (if the repayment period is 6 months, or 3 months. Calculate your line of credit or loan payments. Required Information. Borrowing Reason: Select, Pay Off My Debt Sooner, Reduce Monthly Interest Costs. Annual interest rate for this loan. Interest is calculated monthly on the current outstanding balance of your loan at 1/12 of the annual rate. Information and. How to Calculate Monthly Loan Payments · If your rate is %, divide by 12 to calculate your monthly interest rate. · Calculate the repayment term in. Step 1: Calculate the Daily Interest Rate. You first take the annual interest rate on your loan and divide it by to determine the amount of interest that. An annual percentage rate (APR) is a measure that's used to make it easier to understand how much borrowing money will cost. Free online calculator to find the interest rate as well as the total interest cost of an amortized loan with a fixed monthly payback amount. Interest is accrued daily and charged as per the payment frequency. Rates used for calculations are not considered rate guarantees or offers. Calculations. Assumes that the interest rate remains constant throughout the amortization period. All loans are subject to B2B Bank approval and the calculations shown may. L = loan amount r = interest rate, if floating rn is the interest rate in year n n = tenor of the loan (if the repayment period is 6 months, or 3 months. Calculate your line of credit or loan payments. Required Information. Borrowing Reason: Select, Pay Off My Debt Sooner, Reduce Monthly Interest Costs. Annual interest rate for this loan. Interest is calculated monthly on the current outstanding balance of your loan at 1/12 of the annual rate. Information and. How to Calculate Monthly Loan Payments · If your rate is %, divide by 12 to calculate your monthly interest rate. · Calculate the repayment term in.

How to use Credit Karma's loan calculator · Loan amount · Loan term · Interest rate. How to Use Our Loan Interest Calculator There are three main components when determining your total loan interest: To use the calculator, you will input. The basic loan payment formula includes your loan principal amount (P), interest rate (r), and loan term (T). Calculate monthly payments and interest costs for a range of loans with the RBC business loan calculator. The formula is: Simple Interest = Principal × Rate × Time. What are the advantages of using a loan interest rate calculator? A loan. Learn how to calculate auto loan interest using our car loan calculator method. This is a necessary step in determining exactly how much your monthly payment. Interest is calculated monthly at 1/th of the annual rate times the number of days in the month on the current outstanding balance of your loan. To calculate the Loan Amount with Interest is calculate using the formula: =B8*. Figure 8. The Loan Amount with Interest over five years is $13, This. The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline; it may not be the same amount you receive. How to Calculate Interest-Only Loan Payments · Divide your interest rate by the number of payments in a year (12) to get your monthly interest rate: ÷ Interest is accrued daily and charged as per the payment frequency. Rates quoted are not considered rate guarantees. Calculations assume that the interest rate. Interest on a loan, such as a car, personal or home loan, is usually calculated daily based on the unpaid balance. This typically involves multiplying your loan. the formula for calculation is: EMI = [p x r x (1+r)^n]/[(1+r)^n-1]; car loan calculator: the car loan calculator helps you determine your EMIs you pay to your. Interest amount = loan amount x interest rate x loan term. Just make sure to convert the interest rate from a percentage to a decimal. For example, let's say. Divide the amount of the additional payment by the amount loaned to determine the simple interest rate. For example, consider a loan of $1,, which must be. Interest on a loan, such as a car, personal or home loan, is usually calculated daily based on the unpaid balance. This typically involves multiplying your loan. How to Calculate Interest Rate on a Loan: Principal Loan Amount x Interest Rate x Repayment Tenure = Interest. For more details click here. To calculate the periodic interest rate for a loan, given the loan amount, the number of payment periods, and the payment amount, you can use the RATE. We calculate the monthly payment, taking into account the loan amount, interest rate and loan term. The pay-down or amortization of the loans over time is. Use the formula Interest = P x R x T, where P is the principal, R is the interest rate, and T is the term of the loan. For example, to find the interest of a.

Mortgage Interest Rates In Texas

Current mortgage rates in Texas are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. Read more about the up-to-date. Current Mortgage Rates ; 07/11/, %, % ; 07/18/, %, % ; 07/25/, %, % ; 08/01/, %, %. Compare Texas mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Current 30 year-fixed mortgage refinance rates are averaging: %. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. On Wednesday, September 04, , the current average year fixed mortgage interest rate is %, down 2 basis points from a week ago. For homeowners looking. Top 5 Originators in Texas. %. Pennymac Home Loans. %. US Bank ; Originations by Property Type. %. Planned Unit Development. %. Single Family. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Mortgage rates were record-low in , followed by a steep increase that doubled the rates in and Current mortgage rates in Texas are % for a 30 year fixed loan, % for a 15 year fixed loan and % for a 5 year ARM. Read more about the up-to-date. Current Mortgage Rates ; 07/11/, %, % ; 07/18/, %, % ; 07/25/, %, % ; 08/01/, %, %. Compare Texas mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Current 30 year-fixed mortgage refinance rates are averaging: %. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. On Wednesday, September 04, , the current average year fixed mortgage interest rate is %, down 2 basis points from a week ago. For homeowners looking. Top 5 Originators in Texas. %. Pennymac Home Loans. %. US Bank ; Originations by Property Type. %. Planned Unit Development. %. Single Family. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Mortgage rates were record-low in , followed by a steep increase that doubled the rates in and

Home Loan Rates ; Home Equity Line of Credit · Open, N/A, % - % ; Home Improvement · , % - %, N/A. The mortgage rates in Texas are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September 03 Amegy Bank offers conventional home loans 1 with an interest rate that remains the same for the entire term. It's perfect for homeowners wanting a predictable. Customized mortgage rates ; 7/6 ARM, % (%), $2, added to closing costs, $2, ; year fixed, % (%), $ added to closing costs, $3, Today's mortgage rates in Texas are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Check out. If you have an existing loan on your home, the VLB cannot provide refinancing to lower your interest rate, nor can the VLB Veterans Housing Assistance Program. Mortgage amount · Interest rate · Term in years · Monthly payment · Loan origination percent · Discount points · Other fees · Annual Percentage Rate (APR). The average Texas rate for a fixed year mortgage is % (Zillow, Jan. ). Texas Jumbo Loan Rates. In general, the conforming limit for mortgages in the. TODAY'S MORTGAGE RATES If you like a rate, apply today. ; % · % APR · % · % · % APR ; % · % APR · % · % · % APR ; %. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday. Find and compare Texas' current home loan and refinance rates from banks and mortgage lenders. TX's average year fixed mortgage rate at %. The mortgage rates in Texas are % for a year fixed mortgage and % for a year fixed mortgage. These rates are effective as of September 03 According to Forbes, mortgage rates in Houston are hovering around % this summer. The future is impossible to predict, but housing market forecasters expect. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Today's Interest Rates: Unless otherwise stated, the interest rates listed below apply to both the Homes for Texas Heroes and Home Sweet Texas Home Loan. Refinance - 15 Year Conventional Refinance your year mortgage to a year, to potentially reduce your interest rate. The payment on a $, Purchase. Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, % ; In-House Fixed Purchase or Refinance · Term, Annual Percentage Rate ; In-House Adjustable Rate Mortgage (ARM) · Term, Annual Percentage Rate ; Home Equity/. Today's mortgage rates in Corpus Christi, TX are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Our competitive mortgage rates are backed by an experienced staff of mortgage professionals. We update our interest rate table daily, Monday through Friday, so.

Mortgage Payment Breakdown Over 30 Years

Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Before accumulating unsustainable debt, it's important to use a Mortgage Calculator like the one below to help you determine your monthly mortgage payment. Number of payments over the loan's lifetime: Multiply the number of years in For example, a year fixed mortgage would have payments (30x12=). A breakdown of principal and interest paid each month over the life of your loan. What is the differece in payment on a 30 year mortgage vs. a 15 year. Free home loan calculator: Estimate the monthly payment breakdown for your mortgage loan, taxes and insurance Choose a year fixed-rate term for the lowest. The repayment period must be a minimum of 1 year and a maximum of 30 years. pay over the shortened life of your mortgage. Depending on the type of. This calculator will help you to determine the principal and interest breakdown on any given payment number. The number of years and months it will take to repay your mortgage in full. Typically, amortization periods last about 25 – 30 years. Payment frequency. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Before accumulating unsustainable debt, it's important to use a Mortgage Calculator like the one below to help you determine your monthly mortgage payment. Number of payments over the loan's lifetime: Multiply the number of years in For example, a year fixed mortgage would have payments (30x12=). A breakdown of principal and interest paid each month over the life of your loan. What is the differece in payment on a 30 year mortgage vs. a 15 year. Free home loan calculator: Estimate the monthly payment breakdown for your mortgage loan, taxes and insurance Choose a year fixed-rate term for the lowest. The repayment period must be a minimum of 1 year and a maximum of 30 years. pay over the shortened life of your mortgage. Depending on the type of. This calculator will help you to determine the principal and interest breakdown on any given payment number. The number of years and months it will take to repay your mortgage in full. Typically, amortization periods last about 25 – 30 years. Payment frequency. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more.

30 years if you're a first-time buyer purchasing a new build; 25 years in all other cases. If your down payment is more than 20% of your home's price, your. With a year fixed-rate mortgage, you have a lower monthly payment but you'll pay more in interest over time. A year fixed-rate mortgage has a higher. A mortgage amortization schedule shows a breakdown of your monthly mortgage payment over time If you make these payments for 30 years, you'll have paid off. for the length of the loan. While the interest rate may change at different times, the total term length of our ARM loans is 30 years. Rate caps limit the. Calculate mortgage repayments over the life of a loan. Includes all data broken down into easy to read graphs and full amortization schedules. The number of years over which you will repay this loan. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and. Use this free mortgage calculator to estimate your monthly mortgage payments and annual amortization. Loan details. Home price. Down payment. The traditional period for amortization of a mortgage (the time to pay it off) is 25 years. But this is done in periods of five years at a time, though it is. Generally, a year mortgage means higher monthly payments. This means you'll be able to pay the loan off faster and pay less interest over the life of the. The most common loan terms are year fixed-rate mortgages and year fixed-rate mortgages. Depending on your financial situation, one term may be better for. There are four factors that play a role in the calculation of a mortgage payment: principal, interest, taxes, and insurance (PITI). Multiply the number of years in your loan term by 12 (the number of months in a year) to determine the total payments for your loan. For instance, a year. Monthly mortgage payment (year amortization): $2, In this scenario, the year amortization would save you $ a month, but you'd be making payments . Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. 30 Years. 25 Years. Payments of. $2, Required mortgage insurance: $19, payment amount, the closer the calculator will be for estimating your mortgage. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. Use our mortgage calculator to compare different types of mortgages and loan terms to decide which one works best for you. For example, a year mortgage. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. If you buy a home with a loan for $, at percent your monthly payment on a year loan would be $, and you would pay $, in interest. How To Use The Monthly Payment Calculator · Budget for an affordable monthly payment · Compare loan terms to see interest savings · View amortization breakdown per.

Does Doordash Require Car Insurance

DoorDash requirements for drivers are equally vague, stating, “You can use any car to deliver. What kind of insurance do delivery drivers actually need? This. Door Dash does provide insurance. But it only kicks in once the DoorDash driver has food in the car. It doesn't apply while driving to a restaurant. Postmates. Yes. It is illegal to operate a vehicle without insurance coverage. If you have a loan on the vehicle, you must carry full coverage insurance. Understanding Auto Insurance Maintained by DoorDash · Dasher Deals · Track Account DetailsOrder HistoryHelpHave an emergency? Doing Business. Become a. As detailed above, unlike most food delivery services, DoorDash does provide basic liability car insurance to its drivers. Unfortunately, this insurance is. Grubhub and Instacart do not appear to provide any insurance. DoorDash has a commercial auto insurance policy that covers up to $1,, in bodily injury. Yes, you need special insurance to drive for DoorDash. If you do not tell your personal car insurance company about driving for DoorDash and purchase. Do you perform gig work for Amazon, Uber, Lift, Grubhub, Shipt, Instacart or Doordash or another rideshare or personal delivery service? If you do, you more. For its drivers, DoorDash requires them to “maintain an up-to-date auto insurance policy. Damages sustained to your vehicle in an auto accident are your. DoorDash requirements for drivers are equally vague, stating, “You can use any car to deliver. What kind of insurance do delivery drivers actually need? This. Door Dash does provide insurance. But it only kicks in once the DoorDash driver has food in the car. It doesn't apply while driving to a restaurant. Postmates. Yes. It is illegal to operate a vehicle without insurance coverage. If you have a loan on the vehicle, you must carry full coverage insurance. Understanding Auto Insurance Maintained by DoorDash · Dasher Deals · Track Account DetailsOrder HistoryHelpHave an emergency? Doing Business. Become a. As detailed above, unlike most food delivery services, DoorDash does provide basic liability car insurance to its drivers. Unfortunately, this insurance is. Grubhub and Instacart do not appear to provide any insurance. DoorDash has a commercial auto insurance policy that covers up to $1,, in bodily injury. Yes, you need special insurance to drive for DoorDash. If you do not tell your personal car insurance company about driving for DoorDash and purchase. Do you perform gig work for Amazon, Uber, Lift, Grubhub, Shipt, Instacart or Doordash or another rideshare or personal delivery service? If you do, you more. For its drivers, DoorDash requires them to “maintain an up-to-date auto insurance policy. Damages sustained to your vehicle in an auto accident are your.

DoorDash coverage is automatically given to all drivers. It's not a replacement for car insurance, but it does help in certain limited situations. This basic. How Does Insurance Coverage Work with DoorDash? If you have been injured in a car accident caused by a DoorDash driver, you will need to file an insurance. If you're signed into the DoorDash or Uber app and actively working when an accident occurs, your auto insurance policy may not cover you. However, because of their business model, Grubhub does not have a legal responsibility to cover its drivers with commercial auto insurance. So, if a Grubhub. In order to work for companies like DoorDash, drivers need a personal auto insurance policy that covers the commercial use of a car. Door Dash requires all drivers to have proof of personal car insurance coverage; a driver that damages his own vehicle during a delivery will have to file a. DoorDash drivers (and other similarly employed drivers) usually have two layers of insurance that are applicable to the incident. The driver will have their own. Geico just threatened to terminate my car insurance unless I stop Dashing and get a letter from Door Dash stating that I have terminated my. Is your insurance covering you while you deliver for Doordash? Most personal policies exclude delivery work, meaning they won't cover you while even logged. Geico just threatened to terminate my car insurance unless I stop Dashing and get a letter from Door Dash stating that I have terminated my. If you were going to drive for a rideshare company like Uber or Lyft, you could simply get a personal auto policy with an endorsement (called rideshare coverage). As a driver, you must maintain your auto insurance policy, but your car insurance policy may not cover accidents during active delivery. The coverage applies. Progressive full coverage including ride share coverage. If you don't have that don't EVER say you were doing doordash! You. Getting the right insurance coverage when DoorDash drivers are in accidents can be a bit tricky to figure out. DoorDash offers third-party auto liability. Commercial auto insurance or a special ride-on or endorsement to their existing policy may cover accidents that occur while working for DoorDash, but many. If you're delivering for Instacart, Doordash or Uber Eats, you need additional auto insurance coverage. This can be rough, especially when considering all. DoorDash provides its drivers with commercial auto insurance coverage that is applicable when the driver is actively fulfilling an order. However, this coverage. Therefore, vehicle damage should be addressed by the Dasher's personal insurance provider. If this does not cover repair costs, they may need to obtain. Will Doordash Pay For a Car Accident in Texas? DoorDash carries up to $1 million in insurance coverage that can be pursued when their driver is actively. The company's website also says excess auto insurance coverage applies only after the driver goes through their own auto insurance policy. All DoorDash drivers.

How Does Bank Of America Travel Rewards Work

Bank of America® Premium Rewards® Elite credit card · Unlimited 2 points for every $1 spent on travel and dining purchases and points per $1 spent on all. How much are Bank of America credit card points worth? Bank of America points are worth 1 cent per point when you redeem them for statement credits. There are. Bank of America Preferred Rewards® members earn 25%% more points on every purchase. That means you could earn to points on travel and dining. How do travel rewards credit cards work? With our Travel Rewards credit card, you earn points for both travel purchases—3 points per $1 spent—and everyday. The Bank of America Travel Rewards Secured Credit Card offers a budget-friendly option for individuals looking to build or improve their credit. With a $0. The Bank of America Unlimited Cash Rewards provides cash back and intro APR offers, but its Travel Rewards offers points and has no foreign transaction. It works as a starting travel credit card. Also helps if you already have a BOA account. It was the first travel card I got like 10+ years. Cardholders earn a flat points on all purchases. You're also eligible to earn a modest welcome offer that's worth 25, points, or $, if you spend. Select your oldest travel purchases to redeem the points, and you will get the cashback as a statement credit on your card. Bank of America® Premium Rewards® Elite credit card · Unlimited 2 points for every $1 spent on travel and dining purchases and points per $1 spent on all. How much are Bank of America credit card points worth? Bank of America points are worth 1 cent per point when you redeem them for statement credits. There are. Bank of America Preferred Rewards® members earn 25%% more points on every purchase. That means you could earn to points on travel and dining. How do travel rewards credit cards work? With our Travel Rewards credit card, you earn points for both travel purchases—3 points per $1 spent—and everyday. The Bank of America Travel Rewards Secured Credit Card offers a budget-friendly option for individuals looking to build or improve their credit. With a $0. The Bank of America Unlimited Cash Rewards provides cash back and intro APR offers, but its Travel Rewards offers points and has no foreign transaction. It works as a starting travel credit card. Also helps if you already have a BOA account. It was the first travel card I got like 10+ years. Cardholders earn a flat points on all purchases. You're also eligible to earn a modest welcome offer that's worth 25, points, or $, if you spend. Select your oldest travel purchases to redeem the points, and you will get the cashback as a statement credit on your card.

How the Preferred Rewards/Banking. Rewards for Wealth Management. Bonus works. • If you do, you will need to request any future Cash. Rewards. Redemption for. If you redeem them as cash towards travel, they then use a multiplier, which means instead of one point equaling 1 cent, every point is then cents. If. Once enrolled, you'll have access to lifestyle benefits — premium offers, experiences and services curated across luxury categories including travel, automotive. Does Bank of America work internationally? So, how does Bank of America work for international travel? The good news is that BoA credit and debit cards are. The Bank of America® Travel Rewards credit card boosts your rewards to 3 points per $1 spent on travel booked through the Bank of America® Travel Center. That. With cash in hand, you can book any travel or pay for any expense. You'll also have the opportunity to increase the value you receive from these rewards by. Flexibility to choose how you redeem your points – redeem for cash back as a deposit into Bank of America® checking or savings accounts, for credit to eligible. Cardholders of the Bank of America® Travel Rewards credit card can earn points per $1 spent on all purchases. This works out to $ per point — that's a. Cardholders earn a flat points on all purchases. You're also eligible to earn a modest welcome offer that's worth 25, points, or $, if you spend. Redeem points for a statement credit to offset travel and dining purchases, and for travel with no blackout dates at the Bank of America® Travel Center. This. MoneyGeek evaluates the Bank of America® Travel Rewards card, a flexible travel card that offers travel points on all purchases. Cardholders of the Bank of America® Travel Rewards credit card can earn points per $1 spent on all purchases. This works out to $ per point — that's a. Rebates for air travel-related fees like accelerated airport security, checked-luggage, charges, in-flight food and more. Well-rounded protection. 5x points on all air & hotel purchases booked on American Express Travel. Centurion Lounge/Priority Pass lounge access (enrollment required for Priority Pass). How Much Are Bank of America Points Worth? Every Bank of America point is worth up to 1 cent, so for every points that you earn, the maximum value you can. How can I spend or redeem my credit card rewards? Bank of America's Virtual Travel Card solution generates a one-time, virtual account number every time you need to pay — helping companies optimize their travel. Bank of America® Travel Rewards Credit Card for Students cardholders can earn $ online bonus points after spending $1, in purchases in the first 90 days. Select your Bank of America credit card as the payment method and choose the amount of rewards you want to apply. You can use rewards to cover all or a portion.

1 2 3 4 5 6 7