spark-servis.ru

Overview

Low Interest Rate Investment Strategy

Low interest rate environments doesn't shift my investment strategies. Many of my different income streams depend on time. Interest rates and. And with slightly lower expected returns on investing, paying down debt comes out ahead even at slightly lower interest rates. The reverse goes for a more. A low interest rate environment is defined as a condition when the risk-free rate of interest is lower than the historic average. Long-term interest rates are one of the determinants of business investment. Low long-term interest rates encourage investment in new equipment and high. Buying bonds from companies that are highly rated for being low-risk by the mentioned agencies is much safer, but this earns a lower rate of interest. Bonds can. Strategies have evolved that can help buy-and-hold investors manage this inherent interest rate risk. One of the most popular is the bond ladder. A laddered. Active investors use the carry trade across currencies to take advantage of divergence from interest rate parity by borrowing in a lower-yield currency and. While it's important to stay aware of market conditions as they evolve, “successful investing has far less to do with predicting which way interest rates will. BlackRock's systematic alternative strategies seek differentiated risk and return profiles with low correlation to broad asset classes to help diversify 60/ Low interest rate environments doesn't shift my investment strategies. Many of my different income streams depend on time. Interest rates and. And with slightly lower expected returns on investing, paying down debt comes out ahead even at slightly lower interest rates. The reverse goes for a more. A low interest rate environment is defined as a condition when the risk-free rate of interest is lower than the historic average. Long-term interest rates are one of the determinants of business investment. Low long-term interest rates encourage investment in new equipment and high. Buying bonds from companies that are highly rated for being low-risk by the mentioned agencies is much safer, but this earns a lower rate of interest. Bonds can. Strategies have evolved that can help buy-and-hold investors manage this inherent interest rate risk. One of the most popular is the bond ladder. A laddered. Active investors use the carry trade across currencies to take advantage of divergence from interest rate parity by borrowing in a lower-yield currency and. While it's important to stay aware of market conditions as they evolve, “successful investing has far less to do with predicting which way interest rates will. BlackRock's systematic alternative strategies seek differentiated risk and return profiles with low correlation to broad asset classes to help diversify 60/

Collateralized Mortgage Obligations (CMO) and Real Estate Mortgage Investment Conduits (REMIC). lower the interest rate the issuer pays because the risk of. Short-term loans are less risky and, as a result, have lower mortgage rates. The trade-off for these kinds of loans are larger monthly payments since you're. As interest rates fall, it lowers the “income opportunity cost” of investing in stocks There is no assurance that any investment strategy will be successful. Opting for a broadly diversified portfolio of low-cost index funds and ETFs is the best way to reduce the costs of investing—including risk—while still. Money market funds are low-risk as they invest in stable, short-term debt instruments and certificates of deposit. Though rates are still relatively modest. Cash investments to consider · Sweep accounts: By transferring unused funds into safe, savings or investment options at the end of each business day, sweep. Daily Treasury PAR Yield Curve Rates. This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market. Some economists and market analysts believe that interest rate increases have an adverse impact on equity markets. Their reasoning is that money becoming. Make sure that your risk tolerance and your investment strategy match. Even federally insured savings accounts carry risks -- that their low interest rate. It reduced the top corporate income tax rate from 35 to 21 percent, increased investment incentives by making equipment investment fully tax-deductible, and. interest rates rise, and low interest rate environments increase this risk. strategy or investment product. Information contained herein has been. that were struggling in a low interest rate environment could borrow at low Information does not constitute a recommendation of any investment strategy. Access tools and calculators to help you plan your investment strategy. An Higher rates to stay, though policy divergence won't. Published June 28, This investment technique provides the benefit of blending higher long-term rates with short-term liquidity. The resulting diversification helps to reduce risk. low interest rates and strong equity market performance. Then Senior Investment Strategist—Investment Strategy Group; Elizabeth Sohmer, CFA. from the coupon interest and capital appreciation. If they lower interest rates by 1%. treasuries across the board will rally and there will be. Active investors use the carry trade across currencies to take advantage of divergence from interest rate parity by borrowing in a lower-yield currency and. Should these savings and investment trends reverse, the neutral rate of interest could go back up. policy too much against the risk of tightening too little.”. Treasury bonds. 20 to 30 years. Treasury bills. Four to 52 weeks ; Liquidity. Low return. Regular income. It may not keep up with inflation ; A guaranteed rate of. The SEC's Office of Investor Education and Advocacy is issuing this Investor Bulletin to make investors aware that market interest rates and bond prices move in.

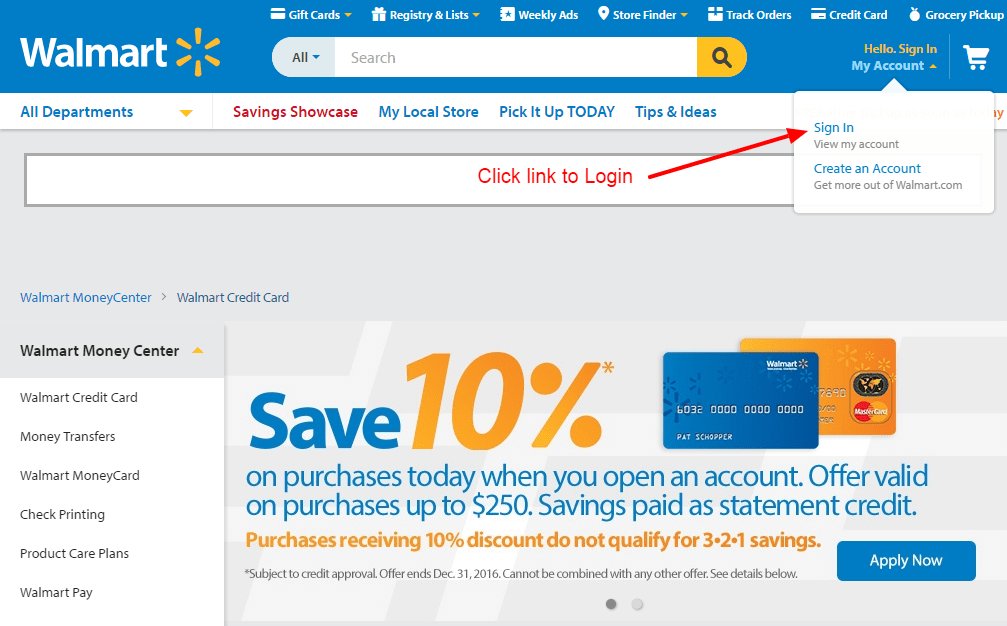

How To Get Credit At Walmart

If you've already saved credit, debit or gift cards to your Walmart account, you'll see them listed. If you haven't saved any cards yet, we'll ask you to. Open your Walmart app, select Services > Walmart Pay > Set Up Walmart Pay. Getting a Credit Card · Using a Credit Card · Credit Card Rewards · Credit Card. The partnership between Capital One and Walmart® is ending. As part of this transition, the Capital One Walmart Rewards Card and the Walmart Rewards® Card are. The system is "powered by" MoneyGram and CheckFreePay, and Walmart claims that you may be able to have the payments post on the same day you pay them. If you go. Go to spark-servis.ru · Sign up for a monthly auto-renewing Walmart+ membership or log in to your existing Walmart+ membership account. I saw/heard that the CareCredit credit card is accepted in my Walmart store. How can I find more information and/or apply. Apply today for the Walmart Rewards Mastercard online. The no annual fee credit card earns you reward dollars in store, online, at gas stations and. Credit cards; Pay by bank; Gift cards (Note: you cannot use a gift card to Get the Walmart App · Sign-up for Email · Safety Data Sheet · Terms of Use. Refund Timelines · Credit/Debit Card. Up to 10 business days · Pre-Paid Credit/Debit Card. Up to 30 business days · Walmart Gift Card. Up to 3 hours · PayPal. Up to. If you've already saved credit, debit or gift cards to your Walmart account, you'll see them listed. If you haven't saved any cards yet, we'll ask you to. Open your Walmart app, select Services > Walmart Pay > Set Up Walmart Pay. Getting a Credit Card · Using a Credit Card · Credit Card Rewards · Credit Card. The partnership between Capital One and Walmart® is ending. As part of this transition, the Capital One Walmart Rewards Card and the Walmart Rewards® Card are. The system is "powered by" MoneyGram and CheckFreePay, and Walmart claims that you may be able to have the payments post on the same day you pay them. If you go. Go to spark-servis.ru · Sign up for a monthly auto-renewing Walmart+ membership or log in to your existing Walmart+ membership account. I saw/heard that the CareCredit credit card is accepted in my Walmart store. How can I find more information and/or apply. Apply today for the Walmart Rewards Mastercard online. The no annual fee credit card earns you reward dollars in store, online, at gas stations and. Credit cards; Pay by bank; Gift cards (Note: you cannot use a gift card to Get the Walmart App · Sign-up for Email · Safety Data Sheet · Terms of Use. Refund Timelines · Credit/Debit Card. Up to 10 business days · Pre-Paid Credit/Debit Card. Up to 30 business days · Walmart Gift Card. Up to 3 hours · PayPal. Up to.

Once you apply for the Capital One® Walmart Rewards™ Mastercard®, Capital One will automatically consider you for the Walmart Rewards® Card if your credit isn't. Each Walmart credit card offers the same base rewards, but the Capital One Walmart Rewards® Mastercard® offers a more in-depth rewards program. Once signed in, you will be prompted to add a credit, debit, EBT or gift card if you currently do not have one already added to your Walmart account. That's it—. Your redeemable code can be found on your Walmart+ member page and in the 'savings' tab within the member hub in your Walmart app. Credit shall not apply to. Open a new card, add $50+ & be automatically entered for a chance to win $*. Open an account. Earn up to $75 cash back each year on Walmart purchases.¹. Easily manage & access your money. New Walmart MoneyCard accounts now get NO minimum balance or credit check to get a card today. EASY WAYS TO MAKE. Apply at checkout. Shop at spark-servis.ru or in the app and choose One at checkout. · Check out online. Now you can easily complete your purchase. · Select your plan. Must be 18 or older to purchase a Walmart MoneyCard. Activation requires online access & identity verification (including SSN) to open an account. Mobile or. For additional information on Walmart+ memberships, including a summary of their benefits and benefit availability, please go to spark-servis.ru or call 1. Failure to make monthly minimum payments on time may negatively impact your credit score. Use your One card at any Walmart Money Center, cashier, or Customer. 1. Apply online. Visit spark-servis.ru before your shop. · 2. Submit application. Enter your purchase total & some additional details. · 3. Go to checkout. Manage your account and redeem your Walmart credit card rewards Have questions about your Capital One Walmart Rewards® Card or Walmart. How to use Affirm in store · 1. Apply online. Visit spark-servis.ru before your shop. · 2. Submit application. Enter your purchase total & some additional. Getting a Walmart MoneyCard is easy. You can order one online through the Walmart MoneyCard website, and your card will arrive in two weeks. To avoid waiting. Open an account online or pick up a starter card like this at a Walmart store. Must be 18 or older to purchase a Walmart MoneyCard. Activation requires online. You only get 5% if you buy online and have the items shipped or groceries delivered. The card is added to your Walmart app and it's super easy. Exceed Cardholders who qualify for the first $25 credit will receive a second $25 credit if you receive additional Direct Deposit payments from Walmart. Earn $ Cash Back and Get a Walmart+ Statement Credit. cashRewards. Annual Walmart is a registered trademark of Walmart Apollo, LLC. ↵. 5. Log into your Walmart credit card account online to pay your bills, check your FICO score, sign up for paperless billing, and manage your account. Easily manage & access your money. New Walmart MoneyCard accounts now get: Get your pay up to 2 days early with direct deposit. ¹. Earn cash back.

What Do Lyft Drivers Get Paid

All in all it works out to around $23/hour, after taking out Lyft's cut and the cost of my rental car. Grow the money you earn on Lyft with cashback and other perks Designed exclusively for drivers on the Lyft platform, the Lyft Direct app gives you access to. How much do Lyft Driver jobs pay per hour? The average hourly pay for a Lyft Driver job in the US is $ Hourly salary range is $ to $ You'll get paid weekly, and you can cash out in an instant using Express Pay. Customers can leave tips for good service, and % of tips go to the driver. The. How much do Lyft Driver jobs pay per hour? The average hourly pay for a Lyft Driver job in the US is $ Hourly salary range is $ to $ With that being said, a large-scale review of Lyft and Uber drivers found that hourly income for Lyft is usually around $2 more than Uber. For example, Lyft's. Base fare: the amount you earn for starting a ride. Time: the amount you earn for every minute you drive. Distance: the amount you earn for every mile you drive. Your weekly deposit includes your driver earnings from the previous Lyft week. The Lyft week runs from Monday at 5 AM to the following Monday at AM. On average, drivers may earn anywhere from $15 to $25 per hour before expenses in many cities. Do Lyft drivers make more in certain cities? Yes, earnings for. All in all it works out to around $23/hour, after taking out Lyft's cut and the cost of my rental car. Grow the money you earn on Lyft with cashback and other perks Designed exclusively for drivers on the Lyft platform, the Lyft Direct app gives you access to. How much do Lyft Driver jobs pay per hour? The average hourly pay for a Lyft Driver job in the US is $ Hourly salary range is $ to $ You'll get paid weekly, and you can cash out in an instant using Express Pay. Customers can leave tips for good service, and % of tips go to the driver. The. How much do Lyft Driver jobs pay per hour? The average hourly pay for a Lyft Driver job in the US is $ Hourly salary range is $ to $ With that being said, a large-scale review of Lyft and Uber drivers found that hourly income for Lyft is usually around $2 more than Uber. For example, Lyft's. Base fare: the amount you earn for starting a ride. Time: the amount you earn for every minute you drive. Distance: the amount you earn for every mile you drive. Your weekly deposit includes your driver earnings from the previous Lyft week. The Lyft week runs from Monday at 5 AM to the following Monday at AM. On average, drivers may earn anywhere from $15 to $25 per hour before expenses in many cities. Do Lyft drivers make more in certain cities? Yes, earnings for.

But how much will you earn? Neither company pays an hourly rate. Earnings vary widely depending on how many fares you accept, when you drive, the expenses you. If you calculate the per ride earnings, Lyft pays drivers an average of $ per minute while Uber pays drivers an average of $ per minute. The study also. Earn 10–40% more per ride with Turbo. You'll see Turbo times every week during busy times. Just drive when they're offered and watch your earnings stack up. In their policy it straight says drivers are paid 70% after all fees and if not they will pay you the difference. Driver (Independent Contractor). $ per hour ; Independent Contractor. $ per hour ; Owner Operator Driver. $ per week ; Transporter. $ per hour. Driver (Independent Contractor). $ per hour ; Independent Contractor. $ per hour ; Owner Operator Driver. $ per week ; Transporter. $ per hour. Uber, Lyft to pay Mass. drivers $32 minimum wage during rides under $ million settlement. Updated June 27, Chris Lisinski, State House News Service. Starting Fee: Every trip kicks off with a basic fee that passengers pay for the service. · Per-Mile Earnings: You get money for each mile you. Who must file taxes? If you earn more than $ from Uber or Lyft, you must file a tax return and report your driving earnings to the IRS. How much does a Lyft driver make in Florida? The average lyft driver salary in Florida is $52, per year or $ per hour. Entry level positions start at. Glassdoor estimates the average earnings for a Lyft driver to be $19 per hour based on self-reported earnings. While ZipRecruiter is seeing salaries as high as $ and as low as $, the majority of Lyft Driver salaries currently range between $ (25th. After that, you can use Express Pay to cash out any additional earnings. Express Drive deductions for Washington drivers. Note: If you rent a vehicle through. Lyft says it will now "guarantee" drivers will earn at least 70% of the rider fare after fees. Anything less, and Lyft claims they'll pay the difference. The average Lyft Drivers salary ranges from approximately $ per year for Independent Contractor to $ per year for Director of Engineering. Sign Up with Lyft and get a Lyft Sign Up BONUS here: spark-servis.ru Should you Drive for Uber / Drive for Lyft in. How much can you make with Uber? The money you earn through the Driver app is based on what, where, when, and how often you drive. · badge-calendarx When. How to get paid · Free cashouts: Uber Pro Card · If automatic cashouts are your thing, this debit card is for you · Cashouts anytime for a small fee: Instant Pay. Lyft (and similar services) do not pay their drivers a salary or an hourly wage. You're pretty much your own boss, and you work as an independent contractor. Uber and Lyft promised drivers they'd make more than minimum wage—but they're earning as little as $ per hour Imagine if you worked at a drive-through.

Home Loan Program For Healthcare Professional

A TD Bank Medical Professional Mortgage is a home buying program with specific benefits designed to help physicians, surgeons, dentists, residents and fellows. MMP home loans are available as either Government or Conventional insured loans. Government loans can be guaranteed by the Federal Housing Administration (FHA). Medical professional mortgage loans offer several benefits to healthcare professionals. Lower down payment requirements: Medical professional mortgages. Search over local home maintenance, energy assistance grant, and loan programs. Are you a #realestate professional in need #continuingeducation? Healthcare workers who are eligible for the Hero Home Loan Program include doctors, nurses, medical technicians, and other healthcare professionals. *% financing available on purchase transactions of a single family detached, primary residence; a maximum loan amount of $1,, for credit scores up to. Harvard FCU's Medical Professionals Home Loan offers low down payment options and flexibility with underwriting. Sandy Spring Bank is pleased to provide medical professionals a mortgage program1 that makes owning a home affordable, while simplifying the proce. Popular Mortgage Programs for Medical Professionals · FHA Loans – Low down payment solution. · USDA Mortgages – Up to % financing in USDA eligible areas. A TD Bank Medical Professional Mortgage is a home buying program with specific benefits designed to help physicians, surgeons, dentists, residents and fellows. MMP home loans are available as either Government or Conventional insured loans. Government loans can be guaranteed by the Federal Housing Administration (FHA). Medical professional mortgage loans offer several benefits to healthcare professionals. Lower down payment requirements: Medical professional mortgages. Search over local home maintenance, energy assistance grant, and loan programs. Are you a #realestate professional in need #continuingeducation? Healthcare workers who are eligible for the Hero Home Loan Program include doctors, nurses, medical technicians, and other healthcare professionals. *% financing available on purchase transactions of a single family detached, primary residence; a maximum loan amount of $1,, for credit scores up to. Harvard FCU's Medical Professionals Home Loan offers low down payment options and flexibility with underwriting. Sandy Spring Bank is pleased to provide medical professionals a mortgage program1 that makes owning a home affordable, while simplifying the proce. Popular Mortgage Programs for Medical Professionals · FHA Loans – Low down payment solution. · USDA Mortgages – Up to % financing in USDA eligible areas.

Give your entire staff access to the full benefits offered through MedicalPRO HOME. Our no-cost resource for healthcare employers is designed to help retain. Healthcare professionals put so much on the line for strangers everyday. With our home loans for healthcare workers, we honor them helping get their dream. professional, you get a grant towards a 1st time buyer for a house. healthcare employee targeted financing, often little to zero in. Next Door Programs® is the largest National Home Buying Program in the United States, offering grants, down payment assistance, and special programs to teachers. A home loan program to help medical professionals, including residents, doctors, nurse practitioners and more, fulfill their home ownership dreams. To start the. Our Medical Professionals Home Loan Program helps provide flexibility and exclusive benefits to support your unique financial circumstance. The Health Professional Loan and Loan Repayment programs administered by the Department of Health and Senior Services (DHSS) are designed to increase access. We have special home loan solutions for licensed and practicing doctors and dentists, medical residents and fellows, and other eligible medical professionals. The Thank You Heroes Home Rebate Program was solely built to be a safe place for all medical personnel, supporting roles, and families to buy and sell homes. As a medical professional, you could be eligible to borrow with a 10% deposit and have your Lenders Mortgage Insurance waived. Generally, you will require 20%. NO application fees / NO up-front fees · Easy application process and up-front pre-approval. · NO 4-hour home buyer class · Simple Docs Program™ · Low down payment. To learn more about our home loans for healthcare workers or any of our other loan programs, contact us at or apply online today. APPLY ONLINE. Jumbo loans are ideal for medical professionals looking to purchase or refinance luxury homes or condos in high-cost areas. Exceeding the conventional loan. Actively practicing medical doctors, dentists, dental surgeons or veterinarians can finance the entire purchase price of a home with no down payment. Medical Professionals Mortgage Loan Program · At Foothills Bank, you always get great service from real people. Our team of mortgage experts understands the. The next benefit of FHA home loans for healthcare workers is the down payment requirement. The minimum down payment required by healthcare personnel is % of. Special home loans for medical, dental, and veterinary professionals from GTE Financial. Up to % financing with great term options. No mortgage insurance. Borrowers can receive up to 5% of the first mortgage loan amount (maximum of $35,) in down payment and closing cost assistance. Down payment and closing cost. Bremer Bank is providing mortgage loans specifically designed for the growing population of medical professionals looking to purchase or refinance a home who. Additionally, the State has multiple programs available to home buyers that can assist with down payment assistance. These programs can range from 3% to 5% in.

2 3 4 5 6