spark-servis.ru

Prices

Best Way To Invest In Blockchain

top cryptocurrencies, blockchains and How institutional investors are pioneering investments in digital assets and blockchain-related technologies. How To Buy Cryptocurrency. Just like you can open a brokerage account to buy and sell stocks, you can open an account with a cryptocurrency exchange to buy. Ways to invest in crypto · 1. Buying crypto outright · 2. Buying crypto ETPs or crypto-related ETFs on a brokerage platform · 3. Buying cryptocurrency stocks. Find the best blockchain Technology Stocks to buy now. Robinhood how they compare to other companies such as Paypal (PYPL), Nvidia (NVDA) and. Ways to Invest in Crypto, with Tax-Free Scenarios. Equity Trust Company investing and before choosing a provider that is right for you. Equity Trust. As cryptocurrencies experience volatility, whether cryptos is a good investment depends on how much risk you can bear. Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products that. Investment managers, such as Invesco, have launched exchange-traded products that invest in digital assets. Proprietary investment products: Hedge funds and. For US Coinbase or Crypto.)com are the go to's, for EU those work too, but also Binance, Nexo, Bitpanda I would say. (Yes there are more, but. top cryptocurrencies, blockchains and How institutional investors are pioneering investments in digital assets and blockchain-related technologies. How To Buy Cryptocurrency. Just like you can open a brokerage account to buy and sell stocks, you can open an account with a cryptocurrency exchange to buy. Ways to invest in crypto · 1. Buying crypto outright · 2. Buying crypto ETPs or crypto-related ETFs on a brokerage platform · 3. Buying cryptocurrency stocks. Find the best blockchain Technology Stocks to buy now. Robinhood how they compare to other companies such as Paypal (PYPL), Nvidia (NVDA) and. Ways to Invest in Crypto, with Tax-Free Scenarios. Equity Trust Company investing and before choosing a provider that is right for you. Equity Trust. As cryptocurrencies experience volatility, whether cryptos is a good investment depends on how much risk you can bear. Cryptocurrency investors can buy or sell them directly in a spot market, or they can invest indirectly in a futures market or by using investment products that. Investment managers, such as Invesco, have launched exchange-traded products that invest in digital assets. Proprietary investment products: Hedge funds and. For US Coinbase or Crypto.)com are the go to's, for EU those work too, but also Binance, Nexo, Bitpanda I would say. (Yes there are more, but.

You have probably heard of cryptocurrency, a trendy new way of investing your money. Understand that if a cryptocurrency investment seems too good to be true. Another way to diversify your crypto or blockchain portfolio is to invest in cryptocurrency projects which are focus on different industries. Blockchain. Grayscale is a leading crypto asset manager. We transform disruptive technologies of the future into investment opportunities today. HOW TO INVEST VIEW PRODUCTS. You can't currently trade cryptocurrencies with us, but we offer other ways to gain exposure to the crypto market. You can invest in: Funds that own crypto. Blockchain Coinvestors is the best way to invest in blockchain businesses. A single investment accesses global, diversified exposure to leading early stage. From managing your portfolio to helping you decide how much to invest, we act in your best interest to help you make smart decisions. An outline of a dollar. 1. Diversify across cryptocurrencies. A straightforward way to diversify your crypto portfolio is to add new tokens to your existing holdings. 3. How can you invest in digital assets? Targeted exposure through direct investment: Direct ownership of cryptocurrencies through a major crypto exchange. E*TRADE offers ways to gain indirect exposure to popular cryptocurrencies via securities and futures. We expect to offer more investment options as the. Trade in minutes from only €1. Your No.1 European broker for stocks, crypto, indices, ETFs and precious metals. Trade 24/7. Fee-free on all deposits. How to buy cryptocurrency · Bitcoin trusts: You can buy shares of Bitcoin trusts with a regular brokerage account. · Bitcoin mutual funds: There are Bitcoin ETFs. One simple way to invest in blockchain technology is to buy shares in any publicly traded company that's either using or building blockchain. If you buy stocks of these companies, you can hope that the value of the stock appreciates over time. Buying stocks of blockchain companies is the best way to. When prices are fluctuating, how do you know when to buy? Learn more about using dollar-cost averaging to weather price volatility. How do Crypto ETFs work? You can invest in a crypto ETF with the same brokerage account that you would purchase regular ETFs through, and they are typically. 7 Best Blockchain Stocks To Buy Right Now · 1. Riot Blockchain · 3. Visa · 4. Bit Digital · 6. Amazon · 7. PayPal · What Is Blockchain? Blockchain is a digitized. 1. Diversify across cryptocurrencies. A straightforward way to diversify your crypto portfolio is to add new tokens to your existing holdings. Most institutional investors believe in the long-term value of blockchain and crypto/digital assets, and plan to scale digital asset investments over the next. Scammers are using some tried and true scam tactics — only now they're demanding payment in cryptocurrency. Investment scams are one of the top ways scammers. Coinbase Global Inc. (COIN): A leading cryptocurrency exchange, Coinbase stands at the intersection of crypto, blockchain, and the metaverse. It's poised to.

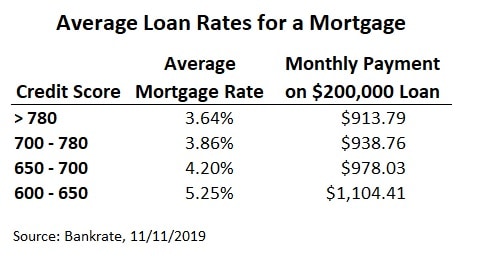

What Is A Good Interest Rate For A Mortgage 2021

As the Federal Reserve bought Treasury bonds and mortgage-backed securities while the economy cooled mortgage rates fell to new record lows. On the week of. Understand how federal student loan interest is calculated and what fees you may need to pay. As of Aug. 23, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Demand for housing was incredibly strong through 20as record-low mortgage rates and high personal savings helped create a homebuying frenzy. NerdWallet's mortgage rate insight On Wednesday, September 11, , the average APR on a year fixed-rate mortgage fell 3 basis points to %. The. loan with a loan term less than 24 months is $ Boats, RV Loan Rates ( and Newer). Effective Date: July 1, Loan Amount, Term, Interest Rate as. A % rate was an anomaly caused by Bubble and recovery. Historically, 5% is a good rate for excellent credit and 20% down payment. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. How do I get the best mortgage rate? The more likely it is you can make your mortgage payments, typically the better interest rate you'll get. What helps. As the Federal Reserve bought Treasury bonds and mortgage-backed securities while the economy cooled mortgage rates fell to new record lows. On the week of. Understand how federal student loan interest is calculated and what fees you may need to pay. As of Aug. 23, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Demand for housing was incredibly strong through 20as record-low mortgage rates and high personal savings helped create a homebuying frenzy. NerdWallet's mortgage rate insight On Wednesday, September 11, , the average APR on a year fixed-rate mortgage fell 3 basis points to %. The. loan with a loan term less than 24 months is $ Boats, RV Loan Rates ( and Newer). Effective Date: July 1, Loan Amount, Term, Interest Rate as. A % rate was an anomaly caused by Bubble and recovery. Historically, 5% is a good rate for excellent credit and 20% down payment. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. How do I get the best mortgage rate? The more likely it is you can make your mortgage payments, typically the better interest rate you'll get. What helps.

Rates are at or near record levels in with the average year interest rate going for %. That is about the same as rates and experts don't think. year fixed-rate mortgage averaged percent with an average point for the week ending August 26, , up slightly from last week when it averaged. Today's Average Mortgage Interest Rates by Term ; Year Fixed. %. % ; Year Fixed. %. % ; Year Jumbo. %. %. The lowest mortgage rate recorded for a year, fixed-rate loan in the U.S. was % in Learn more about the lowest mortgage rates. %. Data source: ©Zillow, Inc. - Use is subject to the Terms of The loan offer with the lowest interest rate isn't necessarily the best. As of Sept. 11, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Fees, points, mortgage insurance, and closing costs all add up. Compare Loan Estimates to get the best deal. Share this. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. Fixed Rate Conventional Mortgage Interest Rates. Effective Date: August 07, Motorcycles and Scooters , 36 Months Term determined by loan. mortgage rate in or to trade up to a more expensive loan. In fact A mortgage rate lock guarantees an interest rate for a specified period. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. This occurred in both late and in April As of and , the average year fixed mortgage rate has dropped even further to % and %. Why did US mortgage rates remain around 3% through the end of ? · Economy is overstimulated due to, among other things, Fed holding rates too. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. The average rate on a year fixed mortgage remained relatively stable at % as of August 22, marking its lowest level since mid-May , according to. Today's rates for August 18, , the national average rate based on MND's primary mortgage market survey for a year fixed purchase or refinance. mortgage interest rate limit increase for the life of the loan. Refinancing or taking on a mortgage in or is one of the all-time great financial. The bottom's not about to fall out here. For example, the While it's always great to have a lower interest rate on your mortgage, that. Historical Listing of Maximum Effective Interest Rates (Home Loan Rate). As December, November, October, September. Over the last 50 years, the average mortgage interest rate has been about 7%. The way to beat the interest rates is to pay a little extra on the.

Auto Loan Refinance Process

Refinance your auto loan and lower your rates. Get pre-qualified online in minutes, with no impact on your credit score. Find out how much you could save! Apply online to refinance your auto loan now. A vehicle loan expert can How long does the refinancing process take? The approval process for a. The process involves shopping around for a new loan with better terms or rates, applying for the new loan, and using it to pay off the original. Wondering When Should I Refinance My Car? · 1. Check your current loan. · 2. There are a variety of sources available to estimate your car's current value. · 3. Auto loan refinancing can be a powerful personal finance strategy. By taking out a new loan to pay off your current loan, you may be able to get a lower. You'll need your monthly income, vehicle information, and the amount of your existing day loan payoff. 2. Get an answer, fast. In practice, auto refinancing is the process of paying off your current car loan with a new one, usually from a new lender. This process can have varying. Answer: Auto loan refinancing is the process of paying off your current car loan with a new loan that offers different terms—typically a new interest rate or. Calculate the value of your car. · Prepare the necessary documents for your application. · Compare rates and fees, then begin the application process. · Get ready. Refinance your auto loan and lower your rates. Get pre-qualified online in minutes, with no impact on your credit score. Find out how much you could save! Apply online to refinance your auto loan now. A vehicle loan expert can How long does the refinancing process take? The approval process for a. The process involves shopping around for a new loan with better terms or rates, applying for the new loan, and using it to pay off the original. Wondering When Should I Refinance My Car? · 1. Check your current loan. · 2. There are a variety of sources available to estimate your car's current value. · 3. Auto loan refinancing can be a powerful personal finance strategy. By taking out a new loan to pay off your current loan, you may be able to get a lower. You'll need your monthly income, vehicle information, and the amount of your existing day loan payoff. 2. Get an answer, fast. In practice, auto refinancing is the process of paying off your current car loan with a new one, usually from a new lender. This process can have varying. Answer: Auto loan refinancing is the process of paying off your current car loan with a new loan that offers different terms—typically a new interest rate or. Calculate the value of your car. · Prepare the necessary documents for your application. · Compare rates and fees, then begin the application process. · Get ready.

Check Your Rate. Tell us a little about yourself and your vehicle, and, if you qualify, you'll receive multiple auto refinancing offers that could help you save. Step 1: Fill out our secure online application for auto loan refinancing. It's fast, free, and takes most people around two minutes to fill out. Just two. How Cash Out Auto Refinancing Can Work For You · Refinance your existing vehicle and "cash-out" the equity in your car up to % of the value · Utilize the loan. Refinancing your auto loan so you have a lower monthly payment can make sense if your income has dipped. The lower payment can help ease the strain on your. Refinancing: Refinancing at a longer repayment term may lower your car payment, but may also increase the total interest paid over the life of the loan. How does refinancing a car work? · Proof of employment and income · Proof of residence · Proof of insurance · Credit history · Vehicle information · Existing car loan. Keep your car. Trade in your car loan. · Lower your interest rate · Reduce your monthly payments · Choice of terms and payment options · Easy application process. As part of this process, your initial loan is paid off and you will only have to make payments on the new loan. Refinancing your auto loan can provide several. The process of refinancing a car loan involves evaluating your current terms, working with a lender, and settling on new loan terms that work better for. Refinancing a car loan entails paying off your current loan with a new auto loan—often with the goals of getting a better interest rate to help lower your. When you refinance your auto loan, you're applying for a new loan with a new lender to pay off the balance of your existing auto loan. Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. 1. Check your current loan. · 2. There are a variety of sources available to estimate your car's current value. · 3. Assemble the information you'll need. · 4. Reap the benefits of refinancing. · Our % online pre-qualification process gives you an offer in minutes without impact to your credit score · You could save. Your current lender needs to meet one of the following requirements: 1) is currently reporting your loan to a major credit bureau, 2) is FDIC or NCUA insured. Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. After all, if you're having trouble paying your bills, the sooner you start saving money, the better. The good news is the car loan refinance process can be. Start the Application Process: Apply with a handful of automotive refinance companies so you can compare their rates. As always, you should limit your. Refinancing your car loan starts with checking your rate. Then you'll confirm details about you, your vehicle, and your current car loan. Steps to Refinance Your Auto Loan · Details of your current loan, such as outstanding balance, interest rate, and remaining term. · Your car's Vehicle.

Beginner Stock Investing Apps

With spark-servis.ru mobile apps for iOS and Android you can invest in 5,+ stocks and ETFs listed on 10 global stocks exchanges. You can also trade 2,+ CFDs on. Robinhood: Robinhood will give you 1 share of free stock when you open a new account, link your bank account and fulfill the conditions in your promotion. You'. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more today. Another great option is to buy fractional shares which allow you to invest in some of the more expensive stocks with a dollar amount that works for you. So, if. The 10 need-to-knows · With investing, you're taking a risk with your money · A stock market is like a supermarket where you can buy or sell shares · You can make. Many of these trading apps will display basic metrics, such as a stock price, daily highs and lows, week highs and lows, price to earnings ratio (PE). Best Investing Apps: Best for Beginners, Crypto, and More · More videos on YouTube · #1: Seeking Alpha: Best Investing App for Research and Analysis · #2: Round. Best for Casual Day Trading: Robinhood · Best No-Nonsense App: Charles Schwab · Best for Mutual Funds With No Minimums: Fidelity · Best for Beginning Investors. Best investment apps to help you make money · Betterment - Best app for automated investing · Invstr - Best app for education · Acorns - Best app for saving. With spark-servis.ru mobile apps for iOS and Android you can invest in 5,+ stocks and ETFs listed on 10 global stocks exchanges. You can also trade 2,+ CFDs on. Robinhood: Robinhood will give you 1 share of free stock when you open a new account, link your bank account and fulfill the conditions in your promotion. You'. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more today. Another great option is to buy fractional shares which allow you to invest in some of the more expensive stocks with a dollar amount that works for you. So, if. The 10 need-to-knows · With investing, you're taking a risk with your money · A stock market is like a supermarket where you can buy or sell shares · You can make. Many of these trading apps will display basic metrics, such as a stock price, daily highs and lows, week highs and lows, price to earnings ratio (PE). Best Investing Apps: Best for Beginners, Crypto, and More · More videos on YouTube · #1: Seeking Alpha: Best Investing App for Research and Analysis · #2: Round. Best for Casual Day Trading: Robinhood · Best No-Nonsense App: Charles Schwab · Best for Mutual Funds With No Minimums: Fidelity · Best for Beginning Investors. Best investment apps to help you make money · Betterment - Best app for automated investing · Invstr - Best app for education · Acorns - Best app for saving.

The best apps for investing are Fidelity, SoFi Invest, TD Ameritrade, E-Trade, Robinhood, Merrill Edge, and Stash. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees. The basic type is a cash account: you buy securities using only the money in your account. There are also margin accounts for experienced investors who borrow. This post covers some apps that can help everyday traders and investors in a number of ways. Read on to learn more about app-based investing. Our list of the best investment apps beginners can use focuses on apps with low funding requirements that are easy to use. Our low-cost investment app is built for investors just like you. Sign up now and begin building your investment portfolio and confidence. Top 5 Free Stock Investing Apps I Use (Plus Rich Sign Up Bonuses) · Robinhood · Public · eTrade. The Stash app is your all-in-one solution offering a portfolio managed by experts, automated saving and investing, Stock-BackR Debit Card, and expert guidance. Investing apps come in many forms. Some can be used as a brokerage platform (meaning, allows you to do trades) and as a stock analysis tool. Some just let you. Robinhood is an app that allows you to buy and sell stocks, ETFs, and options without paying any commission fees. That's right – with Robinhood, you can trade. Join the millions of people using the spark-servis.ru app every day to stay on top of the stock market and global financial markets! In a nutshell. The best stock trading apps for beginners are eToro, XTB and Trading They're all low cost and have a huge range of investment options and. Top Investment Apps for Beginners. Robinhood; Acorns; Stash; Ally Invest; TD Ameritrade. Recommendations Based on User Needs. Trading is a commission-free investment app that allows you to invest in stocks, ETFs, and forex. Trading offers a practice account that allows you to. Robinhood is an investing app that became famous for offering commission-free trades on stocks, ETFs, options, and cryptocurrency. The platform has added a new. The best investment apps for beginners make it easy and inexpensive to get started in investing — with as little as $5 in some cases. spark-servis.ru - Best for portfolio diversification · J.P. Morgan Self-Directed Investing - Best for assisted portfolio building · Robinhood - Best for beginners. SoFi Active Investing is an easy-to-use option with three stand-out features: No account minimums, no annual advisory fees and free stock and ETF trades. You. Here are four brokers or trading platforms that are worth considering for beginners in the US: eToro, Why Did We Pick It? is renowned for its user-friendly. Stash is the first app on this list. It aims to make selecting investments, specifically stocks and exchange-traded funds, quick and easy for starters. It costs.

How Long To Get Fico Score

And even if you check it today and go to apply for a loan or credit card tomorrow, your score may change. Here's when you can expect your credit score to update. However, with favorable scores in the other categories, even someone with a short credit history can have a good score. FICO scores take into account how long. The time it takes to build good credit can be different for everyone. But it generally takes about three to six months to get your first credit score. 2. How long ago did you get your first loan? (i.e., auto loan, mortgage, student loan, etc.) I. Your account is new. It may take a 30 to 45 days for us to populate your score on our website and mobile app. · The FICO Score we have on file for you is more. FICO® Score. However, even people who have not been using credit long may get high FICO® Scores, depending on how the rest of the credit report looks. Your. To generate a FICO® Score, you need at least one account opened for six months or more and at least one account that is reporting to the credit bureaus for the. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. Check your credit report. Get a free credit report. FICO Scores only consider inquiries from the last 12 months. People tend to have more credit today and shop for new credit more frequently than ever. FICO. And even if you check it today and go to apply for a loan or credit card tomorrow, your score may change. Here's when you can expect your credit score to update. However, with favorable scores in the other categories, even someone with a short credit history can have a good score. FICO scores take into account how long. The time it takes to build good credit can be different for everyone. But it generally takes about three to six months to get your first credit score. 2. How long ago did you get your first loan? (i.e., auto loan, mortgage, student loan, etc.) I. Your account is new. It may take a 30 to 45 days for us to populate your score on our website and mobile app. · The FICO Score we have on file for you is more. FICO® Score. However, even people who have not been using credit long may get high FICO® Scores, depending on how the rest of the credit report looks. Your. To generate a FICO® Score, you need at least one account opened for six months or more and at least one account that is reporting to the credit bureaus for the. Here are 10 ways to increase your credit score by points - most often this can be done within 45 days. Check your credit report. Get a free credit report. FICO Scores only consider inquiries from the last 12 months. People tend to have more credit today and shop for new credit more frequently than ever. FICO.

You are eligible to receive your up to date FICO credit score free online every month. With this free online tool, your score is updated every 7 days (should you check it frequently) with no impact to your score. In this article, we'll explain. By law each of the three credit bureaus, TransUnion, Equifax and Experian, must provide you with a free credit report every year. You can obtain these free. Your FICO® Score is calculated from the details in your credit report, including your credit history and record of past payments. The score is made available to. Once you have a credit account opened and being reported, it will take 6 months of credit history to obtain a FICO score. A VantageScore (from. Check your credit score, view your credit report, run score simulations and view credit alerts—all for free—using the mobile app or online banking. Get your credit score at no charge! Discover Scorecard gives you your FICO® Score for Free with no harm to your credit. Learn more. Length of credit history (15%) · How long specific credit accounts have been established · How long it has been since you used certain accounts. How long to create a score, At least six months of data required FICO scores are the most widely used credit scores and have been an industry. The longer you've been using credit, the more it means to your credit score. Members of the Club average just under 22 years of using credit. Even the. It usually takes a few months of consistent credit activity to establish a credit score. Get your credit score for free through Chase's Credit Journey. Get your FICO® Score for free in Online and Mobile Banking. Bank of America credit card customers: Log in to view your score or enroll in the program now. 3. Length of credit history determines about 15% of your FICO credit score. This percentage can be broken into three parts: How long accounts have been. With Credit Close-UpSM, you have free and easy access to your monthly FICO® Credit Score and credit report plus score ingredients and tips. Most people with an credit score have a long credit history, just a little under 22 years. Credit history length does not represent how long you've used. In order to have access to your free FICO Score, you'll typically need to be the primary account holder on a consumer card. Once you meet the eligibility. However, even people who have not been using credit long can have a good FICO score, depending on the other factors mentioned above. To determine the length. I'm spending way to much time trying to figure things out. Or example, only on a he MyFICO app and experian does it show my credit score is in the low s. However, with favorable scores in the other categories, even someone with a short credit history can have a good score. FICO scores take into account how long. To even receive a FICO ® Score, you have to have enough recent information in your credit report. Generally, that means you must have at least one account that.

What Are The Best Current Cd Rates

Current 6-month CD rates · America First Credit Union — % APY · Quontic Bank — % APY · Bask Bank — % APY · Bank5 Connect — % APY · First Internet. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. Best 4-year CD rates. The highest 4-year CD rate today is % from First Internet Bank. Best 5-year CD rates. The highest 5-year CD rate today is % from. CD rates can vary depending on the term and type of CD account you choose. Learn about current CD rates for Fixed Rate, Step Up and No Penalty CDs. The Marcus 6-Year High-Yield CD rate is % Annual Percentage Yield. The 6-year CD is currently the longest term CD offered by Marcus. Lock in a fixed rate with an online-only certificate of deposit. This product is not available in your current location. Find the best 1-year CD rates if you have a short-term savings goal in mind. Current Rates for All Terms ; Account Name: Rising Rate CD, Term: 1st 90 Days, Minimum Balance: $2,, APY*: Interest Rate of % (APY), Appointment. Current 6-month CD rates · America First Credit Union — % APY · Quontic Bank — % APY · Bask Bank — % APY · Bank5 Connect — % APY · First Internet. Current 6-month CD rates · America First Credit Union — % APY · Quontic Bank — % APY · Bask Bank — % APY · Bank5 Connect — % APY · First Internet. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. Best 4-year CD rates. The highest 4-year CD rate today is % from First Internet Bank. Best 5-year CD rates. The highest 5-year CD rate today is % from. CD rates can vary depending on the term and type of CD account you choose. Learn about current CD rates for Fixed Rate, Step Up and No Penalty CDs. The Marcus 6-Year High-Yield CD rate is % Annual Percentage Yield. The 6-year CD is currently the longest term CD offered by Marcus. Lock in a fixed rate with an online-only certificate of deposit. This product is not available in your current location. Find the best 1-year CD rates if you have a short-term savings goal in mind. Current Rates for All Terms ; Account Name: Rising Rate CD, Term: 1st 90 Days, Minimum Balance: $2,, APY*: Interest Rate of % (APY), Appointment. Current 6-month CD rates · America First Credit Union — % APY · Quontic Bank — % APY · Bask Bank — % APY · Bank5 Connect — % APY · First Internet.

View CD Rates of over banks and credit unions so you can be sure to get the best rates on the market! According to the FDIC, average interest rates on CDs ranged from % (for one-month CDs) to % (for five-year CDs), as of January Meanwhile, the. CD Rates ; Tier 1. Tier 2. Tier 3, N/A [ Show Rate ] [ Show Rate ], [ Show Rate ] [ Show Rate ] [ Show Rate ], $0 - $49 $50 - $ $+ ; CD Jumbo CD, [ Show. With a 6-month Regions Relationship CD rate starting at % APY and a month Regions Relationship CD rate starting at % APY, now is the time for you to. The best CD rate is % on a six-month CommunityWide Federal Credit Union CW Certificate Account, but other financial institutions offer similar rates on. What types of CDs does Canvas offer? · Traditional Certificates of Deposit (CDs): · Best Rate % APY · Month HSA CDs · Best Rate % APY · Month IRA CD. TOP THE TREASURY %APY 2-YEAR TREASURY INDEXED CD ; 90 Day CD. % APY* ; 6 Month CD. % APY* ; 9 Month CD. % APY* ; 12 Month CD. % APY* ; 18 Month. Find a U.S. Bank CD (certificate of deposit) that best suits your investing needs, with the CD rate and term that is right for you. Apply now. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. CD Rate Specials ; 7-Month CD Special, %, % ; 7-Month CD Special with Checking · %, % ; Month CD Special, %, %. Summary of the highest CD rates ; Sallie Mae certificates of deposit · %, % ; My eBanc Online Time Deposit · %, % ; Bread Savings certificates of. Current CD rates available through Schwab CD OneSource® ; Rates up to, % APY, % APY. However, there are much higher interest rates on 6-month CDs right now. The best CD rate for a 6-month term is % APY available at iGoBanking. We check rates. Current CD rates available through Schwab CD OneSource® ; Rates up to, % APY, % APY. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. Personal CD Rates ; 1 year, %, % ; 15 month, %, % ; 18 month, %, % ; 2 year, %, %. open savings account only. Select your term during the application process. Select your term during the application process. Boxes. Current CD Rates. TERM. With a Certificate of Deposit account you know exactly what interest rate you'll receive on your CDs during their term. Book your Chase CD account today! FDIC-Insured Certificates of Deposit Rates ; month, % ; 3-year, % ; 4-year, % ; 5-year, %. Minimum deposit required to open is $5, All interest rates and annual percentage yields (APYs) stated above are current as of August 8, and are subject.

Stock Market On Friday

Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, (Sharecast News) - Wall Street stocks closed higher on Friday as investors digested a key inflation reading. Europe close: Stocks end mixed, investors eye. All NYSE markets observe U.S. holidays as listed below for , , and ; Good Friday, Friday, March 29, Friday, April 18, Friday, April 3 ; Memorial Day. The Nasdaq Stock Market · Nasdaq BX · Nasdaq PSX. Options and Futures. Nasdaq Good Friday, Closed. May 27, , Memorial Day - U.S., Closed. June 19, The global stock market is composed of stock exchanges around the world. Most of them are open to trade Monday through Friday during regular business hours. For U.S. stock markets, after-hours trading starts at 4 p.m. and can run as late as 8 p.m. ET. On the TSX, the post-trading session runs from p.m. to 5. Find the latest stock market news from every corner of the globe at spark-servis.ru, your online source for breaking international market and finance news. U.S. STOCKS. U.S.; EMEA · Asia. Stock Indexes. AM EDT 8/30/ U.S., Americas. DJIA, Nasdaq Composite, S&P , DJ Total Stock Market, Russell , NYSE. The Weekly Market Update is published every Friday, after market close. This is for informational purposes only and should not be interpreted as specific. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, (Sharecast News) - Wall Street stocks closed higher on Friday as investors digested a key inflation reading. Europe close: Stocks end mixed, investors eye. All NYSE markets observe U.S. holidays as listed below for , , and ; Good Friday, Friday, March 29, Friday, April 18, Friday, April 3 ; Memorial Day. The Nasdaq Stock Market · Nasdaq BX · Nasdaq PSX. Options and Futures. Nasdaq Good Friday, Closed. May 27, , Memorial Day - U.S., Closed. June 19, The global stock market is composed of stock exchanges around the world. Most of them are open to trade Monday through Friday during regular business hours. For U.S. stock markets, after-hours trading starts at 4 p.m. and can run as late as 8 p.m. ET. On the TSX, the post-trading session runs from p.m. to 5. Find the latest stock market news from every corner of the globe at spark-servis.ru, your online source for breaking international market and finance news. U.S. STOCKS. U.S.; EMEA · Asia. Stock Indexes. AM EDT 8/30/ U.S., Americas. DJIA, Nasdaq Composite, S&P , DJ Total Stock Market, Russell , NYSE. The Weekly Market Update is published every Friday, after market close. This is for informational purposes only and should not be interpreted as specific.

The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from am to 4 pm Eastern time with weekends off. As we look ahead on the economic calendar, I'm not too concerned with next Friday's monthly jobs data given the benign Initial Claims data over the past. Friday morning. The Nasdaq Composite is an unmanaged index representing the companies traded on the Nasdaq stock exchange and the National Market System. Most stock markets around the world will be open for trading from Monday to Friday, and will be closed on the weekends. View the MarketWatch summary of the U.S. stock market with current status of DJIA, NASDAQ, S&P, DOW, NYSE and more. stock market holidays ; Friday, March 29, Good Friday, Closed, Closed ; Friday, May 24, Friday Before Memorial Day, Open, Open. The stock market is open Monday–Friday from AM–4PM EST. US Markets: Get the complete US Stock Markets coverage with latest news, analysis & research on Market Map, Charts, Key Statistics, Sector Performance. Bank holidays and their impact on our trading services ; Good Friday · Easter Monday · Early May Bank Holiday ; NON-trading day. Also GBX/ GBP NON-settlement day in. Good Friday. Friday, March 29, Early Close ( p.m. Eastern Time): The Stock Market Game · Project:Invested · SIFMA Invest! Important Links. Terms. The NYSE is open from Monday through Friday a.m. to p.m. Eastern time. The NYSE may occasionally close early, either on a planned or unplanned basis. Pre-market stock trading coverage from CNN. View pre-market trading Friday · Sep 6, Commodities. Most active Energy Metals Agriculture. Stock market's tumultuous August leaves investors unscathed but disagreement remains on rate path Friday's PCE inflation report: Here's how financial markets. stock market may react accordingly. Key Takeaways. Black Friday is the name given to the day after Thanksgiving when retailers rely on major sales to bring. Market News and Insights; Stock Market News. Stock Market News. Friday, 8/30/ p.m.. Stocks close higher – Major equity markets closed higher, with large-cap. The main stock market index in the United States (US) increased points or % since the beginning of , according to trading on a contract for. Here you can find premarket quotes for relevant stock market futures (eg Dow Jones Futures, Nasdaq Futures and S&P Futures) and world markets indices. US stock market hours: when do the NYSE, NASDAQ, Dow Jones and S&P open Friday. Explore the markets with our free course. Discover the range of. Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. The NYSE and NASDAQ are open Monday-Friday am to pm Eastern Time. There are 9 trading holidays when markets are closed plus several scheduled half-.

Buy Secondary Dental Insurance

Learn more about Aetna's individual and family dental insurance options and how to buy coverage Dental, vision and supplemental. Dental plans · Find a. Individual and Family Plans A healthy smile just got more affordable. Here, individuals and families can purchase dental plans now: Shop Now. It takes only. You may have dual dental insurance coverage if you are covered under two different dental plans. Find out how dual coverage works. There are two major supplemental dental plans, Delta Dental PPO™ – Select Plan and Delta Dental PPO Plus Premier™ – Select Plus Plan. Both plans help cover. But if the Medicare plan you're interested in doesn't, or you want more dental coverage, you may have the option to add supplemental benefits during open. Many people find value in buying dental coverage apart from their medical plan because separate plans usually offer more choices and may have better benefits to. Explore supplemental insurance plans for individuals and families, like dental or vision insurance, to help you plan ahead for life's unexpected events. Regardless if you have primary dental coverage through your employer or with an individual policy, anyone can purchase additional dental coverage in the private. If you have dental insurance but want to reduce costs, CarePlus supplemental dental insurance can save you up to 30% for full coverage dental insurance. Learn more about Aetna's individual and family dental insurance options and how to buy coverage Dental, vision and supplemental. Dental plans · Find a. Individual and Family Plans A healthy smile just got more affordable. Here, individuals and families can purchase dental plans now: Shop Now. It takes only. You may have dual dental insurance coverage if you are covered under two different dental plans. Find out how dual coverage works. There are two major supplemental dental plans, Delta Dental PPO™ – Select Plan and Delta Dental PPO Plus Premier™ – Select Plus Plan. Both plans help cover. But if the Medicare plan you're interested in doesn't, or you want more dental coverage, you may have the option to add supplemental benefits during open. Many people find value in buying dental coverage apart from their medical plan because separate plans usually offer more choices and may have better benefits to. Explore supplemental insurance plans for individuals and families, like dental or vision insurance, to help you plan ahead for life's unexpected events. Regardless if you have primary dental coverage through your employer or with an individual policy, anyone can purchase additional dental coverage in the private. If you have dental insurance but want to reduce costs, CarePlus supplemental dental insurance can save you up to 30% for full coverage dental insurance.

Enroll in a dental-only plan or add dental when you buy a health plan. Certain life events qualify you to enroll in a dental plan outside of open. Dental insurance is a type of supplemental insurance policy for your teeth, gums and mouth. It helps lower the cost you spend on preventative care and certain. All health plans include dental care for children at no extra cost. For adults, a dental plan can be added to your health plan purchase. Medical insurance doesn't typically cover basic care for your teeth and gums. Dental insurance helps fill that gap as a supplemental policy. Depending on. Major insurance companies like Guardian make it easy for individuals and families to shop dental plans, get a free quote, and buy directly online. Or you can. Supplemental dental insurance aims to bridge the gap where a primary dental insurance plan fails to cover care. These plans can cover implants, dentures or. Individual and Family Plans A healthy smile just got more affordable. Here, individuals and families can purchase dental plans now: Shop Now. It takes only. Dental insurance helps you plan for the costs of dental care. Find individual dental insurance plans near you with budget-friendly coverage options and get. That's 1 whole year of coverage FREE! Why wait? Enroll today and take advantage of these exclusive membership fee discounts! DENTAL DIRECT ACTS AS A SECONDARY. In California, Exchange contracts call for the embedded dental plan to always be primary and the standalone plan to pay secondary – this may vary by state. Keep. If you have dental insurance but want to reduce costs, CarePlus supplemental dental insurance can save you up to 30% for full coverage dental insurance. If you are buying dental insurance on your own, we make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans. Exams; Teeth cleanings; X-rays; Fillings; Anesthesia; Dentures and crowns. Before purchasing a specific supplemental dental plan, be sure you understand. Shop affordable individual & group dental insurance plans from America's largest and most trusted dental insurance carrier. If you would like, you can also filter on a specific Insurance Company or whether the plan has Out of Network coverage. If you are looking for a QHP that. When I was browsing through online, it was mentioned a person who already has an dental insurance is eligible to buy a secondary insurance. There are two major supplemental dental plans, Delta Dental PPO™ – Select Plan and Delta Dental PPO Plus Premier™ – Select Plus Plan. Both plans help cover. Most dental insurance is offered by employers to their employees and dependents. If your employer offers a plan, contact your human resource department for. With Progressive Health by eHealth, all it takes is a few minutes to find the dental insurance plan that fits your budget and care needs. You can purchase PPO, HMO, indemnity or a savings plans to help lower your out-of-pocket costs with your primary plan. PPO plans provide a large network with.

Bad Credit Home Buying

The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Can I Buy A House With Bad Credit? According to Experian, a score below FICO score is considered low but remember, lenders can vary what they consider bad. Fortunately, buyers with scores well below that number or adverse events in their credit history can still pursue homeownership through one of the following bad. Can you buy a home if you have bad credit? Try taking these five steps · There are many variables that come into play when you decide to purchase a house. · There. A bad credit score doesn't have to prevent you from owning a home. Learn how to get a home loan with poor credit by following the tips in this quick guide. Can you buy a home if you have bad credit? Try taking these five steps · There are many variables that come into play when you decide to purchase a house. · There. You can get an FHA loan with a credit score but you need 10+ down. if your score is + you can get a loan with % down. FHA loans. USDA loans are a good option if you have a bad credit score and are looking to buy a house in a rural area of Florida. These loans are backed by the United. Fortunately, buyers with scores well below that number or adverse events in their credit history can still pursue homeownership through one of the following bad. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. Can I Buy A House With Bad Credit? According to Experian, a score below FICO score is considered low but remember, lenders can vary what they consider bad. Fortunately, buyers with scores well below that number or adverse events in their credit history can still pursue homeownership through one of the following bad. Can you buy a home if you have bad credit? Try taking these five steps · There are many variables that come into play when you decide to purchase a house. · There. A bad credit score doesn't have to prevent you from owning a home. Learn how to get a home loan with poor credit by following the tips in this quick guide. Can you buy a home if you have bad credit? Try taking these five steps · There are many variables that come into play when you decide to purchase a house. · There. You can get an FHA loan with a credit score but you need 10+ down. if your score is + you can get a loan with % down. FHA loans. USDA loans are a good option if you have a bad credit score and are looking to buy a house in a rural area of Florida. These loans are backed by the United. Fortunately, buyers with scores well below that number or adverse events in their credit history can still pursue homeownership through one of the following bad.

How to Buy a Home in Utah with Bad Credit · Apply an FHA Home Loan · Consider a Co-Signer · Make a Larger Down Payment · Accept a Higher Interest Rate · Improve Your. If you are struggling with bad credit but are looking to purchase your home, there is still a chance that you will find a lender willing to offer you a loan. Candidates for Bad Credit Mortgages Some people with poor credit profiles or a small down payment may have trouble borrowing from conventional lenders. One. 5 Options For Buyers Who Can't Get A Bad Credit Mortgage Loan · 1. Increase Your Available Credit · 2. Add New Accounts (In Bulk) · 3. Pay For Deletions · 4. Stay. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. If a home buyer has bad credit, they have a credit record, but it's likely tarnished by past mistakes. If you have no credit, lenders don't have a way to. bad credit, but that doesn't mean that it will be cheap. Some programs, such as FHA loans, can make it easier to buy a home with poor credit. However, if. Yes, it is possible to buy a home with a bad credit score. However, it can be harder to qualify for a loan and it will likely be much more expensive. Buy a house with bad credit Arizona Buy a House With Bad Credit in Arizona Most Arizona down payment assistance programs require that you have a minimum. You can get an FHA loan with a credit score but you need 10+ down. if your score is + you can get a loan with % down. FHA loans. Is it possible to purchase a house with bad credit, but a good income and stable employment history (with no past bankruptcy)? Navigating the Homebuying Journey Buying a home is an exciting process Bad credit home loan lenders Mortgage Investors Group. Getting a Loan with. Unfortunately, bad credit does mean you won't meet the minimum credit score needed to qualify for traditional or conventional loans, which is the mortgage type. Some lenders specifically make loans for bad credit available but those may only make sense in certain circumstances. Home Loan Options for Borrowers with Poor. Traditionally home loans for bad credit borrowers fell to the risky subprime mortgage lender. How to get a home equity loan with poor credit to should determine. Finally, know that having a bad credit score when you buy a home doesn't have to affect your loan forever. If your credit score improves after you buy a home. Buyers receiving loan greater than $40, must reside in the home purchased at least 15 years. Effective Date: 6/01/24; Source: HOME Purchase Price Limits for. Buying a house with bad credit or low credit score can be challenging, but it's not impossible. Buying a house requires having money for a down payment, a solid. If you're looking to buy a home but have poor credit, Blue Water Mortgage has access to a variety of home loan options for people with bad credit.

What Month Is The Best Time To Buy Furniture

The best months to buy furniture are February, March, April, May, July, August, September, October, November, and December. But if you pay the bill in month 25, and you might owe close to $1, in interest. You have the right to decline financing or a loan through the store. You. The best months of the year to buy furniture are usually towards the end of winter (January and February) or the end of summer (August and September). Typically, the best time to buy patio furniture is between August and October. Throughout these months, stores hold sales to clear out their summer. In my experience, I have found that shopping in the morning is ideal. In fact, I have a local thrift store that has amazing furniture deals and things can go. Is Labor Day a Good Time to Buy Furniture? Labor Day furniture sales are one of the greatest times of the year to buy furniture. Furniture sales usually. Depending on what type of furniture you are looking for, it might be best to do your shopping in the summer, spring or fall. However, certain holidays. It is held two times a year. I believe in April and then October. Do a search on Google to get dates. I have gotten great deals on samples. The only thing is. The late summer is also a great time to buy patio furniture at low prices. If you're looking for patio or outdoor furniture on sale, these seasons would be an. The best months to buy furniture are February, March, April, May, July, August, September, October, November, and December. But if you pay the bill in month 25, and you might owe close to $1, in interest. You have the right to decline financing or a loan through the store. You. The best months of the year to buy furniture are usually towards the end of winter (January and February) or the end of summer (August and September). Typically, the best time to buy patio furniture is between August and October. Throughout these months, stores hold sales to clear out their summer. In my experience, I have found that shopping in the morning is ideal. In fact, I have a local thrift store that has amazing furniture deals and things can go. Is Labor Day a Good Time to Buy Furniture? Labor Day furniture sales are one of the greatest times of the year to buy furniture. Furniture sales usually. Depending on what type of furniture you are looking for, it might be best to do your shopping in the summer, spring or fall. However, certain holidays. It is held two times a year. I believe in April and then October. Do a search on Google to get dates. I have gotten great deals on samples. The only thing is. The late summer is also a great time to buy patio furniture at low prices. If you're looking for patio or outdoor furniture on sale, these seasons would be an.

Some say the best time to buy outdoor furniture is in May, right before the summer begins. Others suggest August-September to be the best time to purchase. While the best months to buy new furniture include January, April, May and August, autumn isn't the best time of year to buy office furniture if you're on a. With Halloween hitting the shelves, October is a good time to find candy, pumpkins, and spooky decorations on sale (but for clearance prices, shop in November). With this in mind, it's highly likely that consumers will see more sales prices and offers during the out of season period. This usually means any time between. September Labor Day sales tend to be good with most places offering free delivery. Stores are motivated to clear out inventory they carry during their season as it is often being financed and they will soon start paying interest on what has. With this in mind, it's highly likely that consumers will see more sales prices and offers during the out of season period. This usually means any time between. The best time to buy a sofa or indoor furniture, in general, is at the end of the summer and winter seasons. January and July are two months in the year well known for producing bargains on new furniture. Why? Retailers are trying to make room for all the new shipments. For some items, it might be the best. The summertime is known for being a good time to shop for indoor furniture. Many furniture dealers offer discounts in. Here's a look at times of the year that are best for buying furniture. The Fourth of July is often mega-sale time for furniture. It also ranks among the best. What is the best month to buy furniture? · End of Winter (January/February) and Late Summer (July and August) · July and December/January · January to April. The best time to buy a sofa or indoor furniture, in general, is at the end of the summer and winter seasons. So, unsurprisingly, the warmer months of the year (typically April through September in most regions) see a huge demand for outdoor furniture. Retailers tend to. Best months to buy a couch. The best months to buy a couch are February, April, May, July, August, September, October, November, and December. 1. Jan. 2. Feb. 3. While the best time of year for buying furniture depends on which type of furniture you're buying, when it comes to sofas and sectionals specifically, the best. January turns out to be one of the best times to shop for some furniture as prices are quite low after making New Year promises. Best Month. Across the board, the best month to buy mattresses is in April or May. New product lines come out in June in time for summer and fall sales, so. Our experts share the best deals on our top-rated products every month. Jan; Feb; Mar; Apr; May; Jun; Jul; Aug; Sep; Oct; Nov; Dec. How It Works. Typically, the best time to buy patio furniture is between August and October. Throughout these months, stores hold sales to clear out their summer.

1 2 3 4 5